Does Your State Tax Business Inventory?

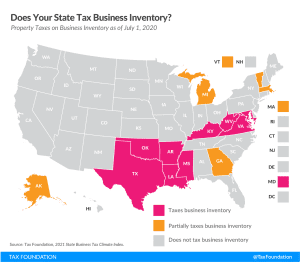

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

3 min read

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

3 min read

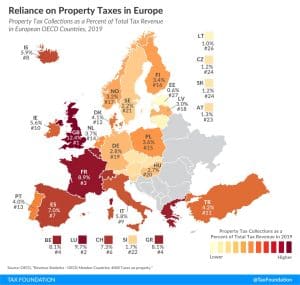

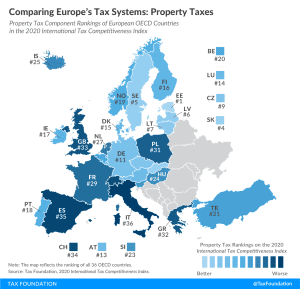

Property taxes are levied on the assets of an individual or business. There are different types of property taxes, with recurrent taxes on immovable property (such as property taxes on land and buildings) the only ones levied by all countries covered. Other types of property taxes include estate, inheritance, and gift taxes, net wealth taxes, and taxes on financial and capital transactions.

1 min read

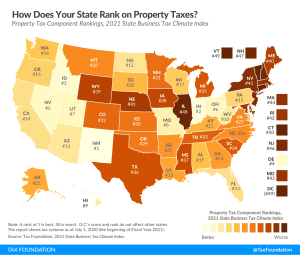

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

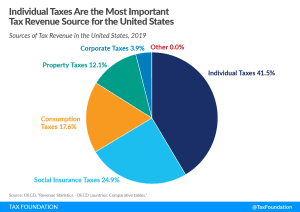

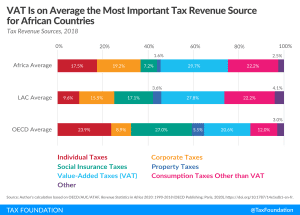

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

We identify 13 of the highest tax reform priorities Nebraska policymakers should consider in their effort to create a more growth-friendly tax code. We also offer a sample comprehensive tax reform plan to show one way policymakers could begin tackling these objectives over the next couple legislative sessions, with further progress to be made in the years ahead.

8 min read

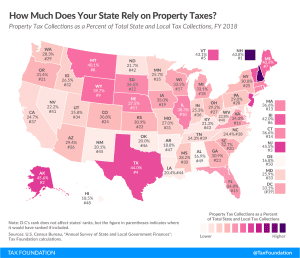

New Hampshire and Alaska rely most heavily on property taxes. Neither have individual income taxes, and in New Hampshire, significant government authority often vested in state government is devolved to the local level, where services are overwhelmingly funded by property taxes.

4 min read

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

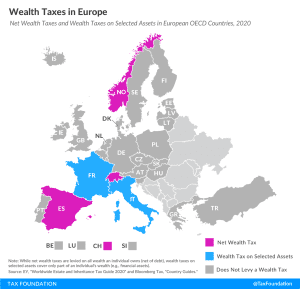

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

In Tuesday’s election, voters in two states—California and Colorado—were tasked with deciding whether to amend their states’ constitution to change how the property tax burden is distributed. In many ways, the ballot measures were mirror images of each other, but the outcomes were similar.

3 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

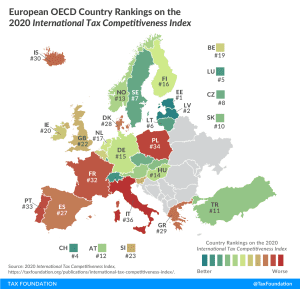

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

A competitive tax code has never been more important, and these tax policy improvements can both strengthen the short-term economic recovery and promote long-term economic growth in Nebraska.

26 min read