All Related Articles

A Carbon Tax, Explained

Every policy has trade-offs, but a well-designed carbon tax has the potential to protect the environment without harming consumers, jobs, or businesses.

The Three Basic Tax Types

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.

Tariffs Are Taxes Too

Even though tariffs are invisible, their effects clearly are not. They might be sold as a tool to strengthen the economy, but tariffs are just taxes that make everyone worse off.

How Do Tax Brackets Work?

Understanding how tax brackets work can inform decisions about performing extra work through a second job or overtime, or pursuing new streams of income.

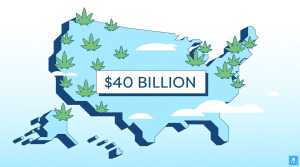

Green Rush: Principles for Taxing Cannabis

Taxing cannabis is brand-new territory. While many states see recreational cannabis as a potential gold mine for tax revenue, the reality of designing a new tax is more complicated.

Not All Taxes Are Created Equal

Discover why there are better and worse ways for governments to raise a dollar of revenue. That’s because no two taxes impact the economy the same.