Last-In, First-Out (LIFO) is one of several accepted methods of inventory accounting. Under LIFO inventory accounting, companies may deduct the cost of inventory at the price of the most recently acquired items and assume that the last inventory purchased is the first to be sold.

How Does Last-In, First-Out (LIFO) Work?

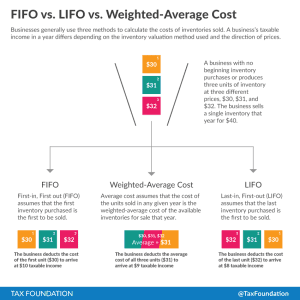

Businesses cannot deduct the cost of inventories when they first produce or purchase them. Instead, businesses must deduct the cost of inventories when they are sold. Sometimes, however, different units of inventory cost different amounts when they were produced or purchased, so the correct value of the deduction is not immediately obvious.

Businesses are generally allowed to choose among three methods when calculating their cost in a given year: First-in, First-out (FIFO); Last-in, First-out (LIFO); and Weighted-Average Cost.

An Example of LIFO

Suppose a business purchases three units of inventory throughout the year at three different prices ($30, $31, and $32). The company sells one unit of their inventory at $40.

Under LIFO, a business assumes that the last inventory purchased is the first to be sold. In this case, the business is assumed to have sold the last unit purchased for $32, so the amount the business can deduct against taxable income is $32. This results in $8 of taxable income.

When the business sells the next unit of inventory, it would then deduct the cost of the second unit for $31; and on the third sale, it would deduct the first unit purchased for $30.

Economics of LIFO

In general, prices in the economy rise over time. By reducing the time between when a unit of inventory is acquired and when its costs are deducted, LIFO prevents inflation from reducing the real value of deductions for costs of goods sold. Economically speaking, LIFO comes closest to deducting the full real value of inventory acquisition. According to the Tax Foundation’s General Equilibrium Model, the elimination of Last-in, First-out accounting for write-offs of future inventory would raise the cost of capital and reduce economic growth, for a relatively small increase in revenue.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe