An inheritance tax is levied upon the value of inherited assets received by a beneficiary after a decedent’s death. Not to be confused with estate taxes, which are paid by the decedent’s estate based on the size of the total estate before assets are distributed, inheritance taxes are paid by the recipient or heir based on the value of the bequest received.

History of the Inheritance Tax

The United States government temporarily levied an inheritance tax for eight years beginning in 1862 to help finance the Civil War, and then again from 1898 until 1902 to help finance the Spanish-American War. Today, inheritance taxes only exist at the state level. The modern federal estate tax was enacted in 1916 and has remained in place since that time, except for a one year period in 2010 when the tax was repealed. The federal government has not levied an inheritance tax since the early 1900s.

For much of the 20th century, state inheritance and estate taxes were designed in conjunction with the federal estate tax, but they did not begin that way. The first state inheritance tax, adopted in Pennsylvania in 1826, preceded the first federal inheritance tax by several decades. New York’s tax on collateral heirs, adopted in 1885, is often seen as a turning point in state inheritance taxation, with many states adopting similar inheritance taxes in the years that followed. By the time the federal government adopted an estate tax in 1916, forty-three states imposed some form of inheritance or estate tax.

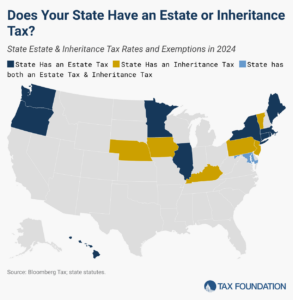

In 1926, the federal government began offering a generous federal credit for state estate and inheritance taxes paid. This credit incentivized all states to impose an estate or inheritance “soak-up tax” because a taxpayer’s total liability was the same whether or not a state imposed its own tax. This made estate and inheritance taxes an attractive revenue option for states, and many states converted their inheritance taxes into estate taxes after the federal model. After the federal government fully phased out its credit for state estate and inheritance taxes in 2005, many states repealed their inheritance and estate taxes. Now, only a handful of states impose an inheritance tax, and many states that retain them have raised their exemption levels over time.

What Is the Impact of Inheritance Taxes?

Inheritance taxes, by taxing individuals who receive bequests, can incentivize individuals who anticipate a forthcoming bequest to avoid living in states that have an inheritance tax, as these taxes reduce the size of the asset transfer they ultimately receive. Since inheritance tax rates vary based on the relationship of the decedent to the heir, inheritance taxes can also influence individuals’ estate planning decisions and cause them to make decisions for tax-related reasons. Compared to other sources of state and local revenue, inheritance taxes are nonneutral in that they are levied on some individuals but not others and at rates that vary based on relationship to the deceased. Inheritance taxes also generate an unstable source of revenue that varies based on the timing of a decedent’s death and the transfer of assets to a beneficiary.

Further Reading

The Estate Tax: Ninety Years and Counting

The Inheritance Tax in the American Commonwealths

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe