Base broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability.

Defining the Ideal Tax Base

Each tax has an implicit “ideal” base, and it is of course possible to include economic activity in the tax base which is not appropriate to the tax. The term “base broadening” is often used to refer to the elimination of exemptions which carve out the implicit base, but the term may also be used for structurally unsound expansions of the tax base. The corporate income tax, for instance, has an implicit base of corporate net income. Base broadening that eliminates tax preferences for specific industries or investments improves the neutrality of the tax code, but expanding the base beyond net income—for instance, by denying structurally-necessary deductions for business expenditures that are used to arrive at the definition of net, rather than gross, income—does not.

Example: Sales Tax Base Broadening

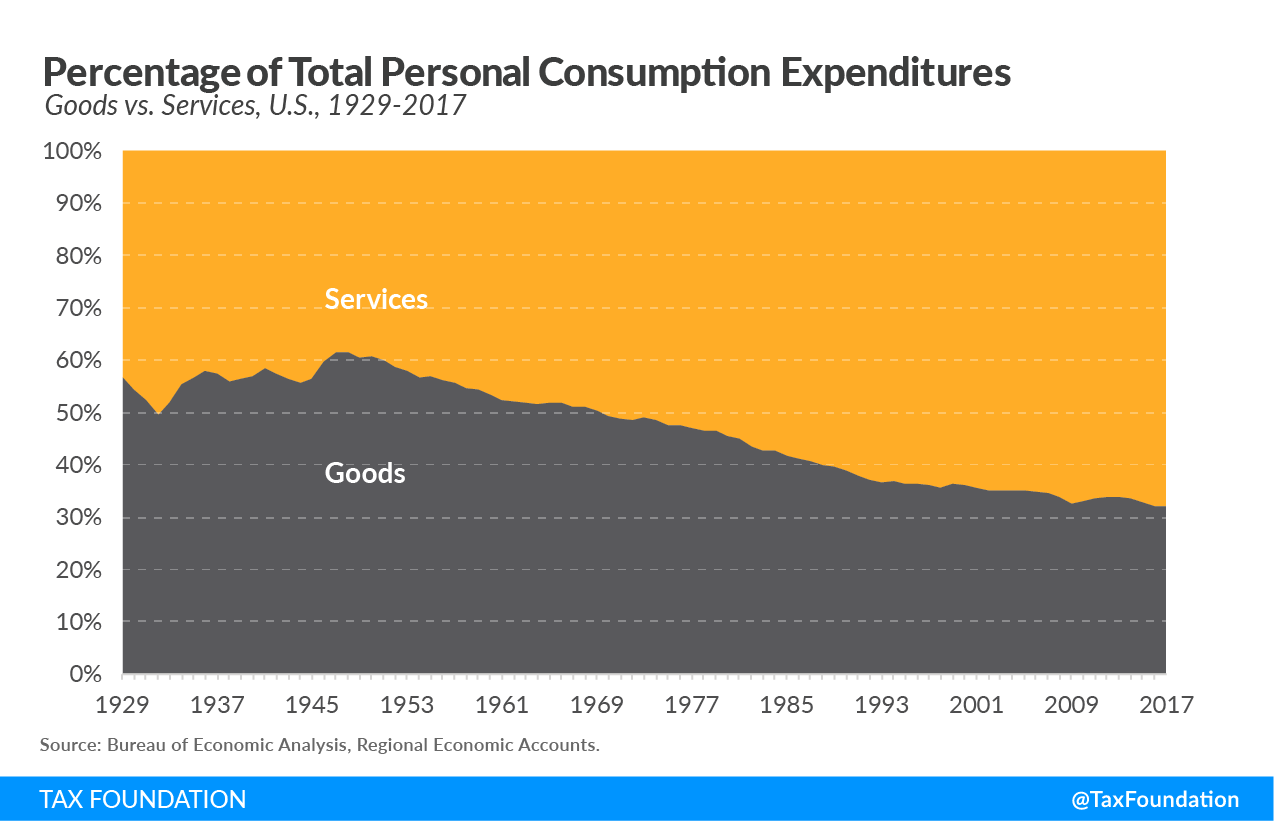

Broadening the sales tax base to include most consumer services, while exempting business inputs to avoid tax pyramiding, would be more economically beneficial and help yield a base stable enough not to require rate increases to maintain revenues. Consumption is a more stable tax base than income, though the failure to tax most consumer services is leading to a gradual erosion of sales tax revenues as services become an ever-larger share of consumption.

Most states impose their sales taxes on a base that consists of most goods—with economically significant policy carveouts—and relatively few services. This was less a conscious choice than an accident of history, as most states imposed their sales taxes during the Great Depression. Services comprised a far smaller share of the economy then, and it was administratively simpler to focus almost exclusively on retail sale of goods.

The sales tax code was built around an economy that no longer exists. Consumer tastes have shifted a greater share of consumption to services and a digital economy is disrupting traditional categories. Notably, consumption of personal services tends to be more discretionary than consumption of goods. Consequently, higher-income individuals tend to spend a greater share of income on services, which are frequently untaxed. Expanding the sales tax base to additional services corrects an accidental wrong in the sales tax as currently formulated, one that presently favors wealthier individuals.

Broadening the sales tax base to include additional final consumer services improves the neutrality of the tax base—but taxing additional business inputs represents a departure from neutrality, as consumer purchases, not business activity, are the implicit base of a retail sales tax.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe