Fiscal Forum: Future of the EU Tax Mix with Dr. Monika Köppl-Turyna

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Stefanie Geringer, a postdoctoral researcher at the Faculty of Law at the University of Vienna and Masaryk University Brno, a certified tax advisor and manager of tax at BDO Austria, about the future of the EU tax mix.

14 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

The FairTax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax, corporate income tax, estate and gift taxes, and payroll tax—with a national sales tax and rebate, abolishing the IRS in the process.

7 min read

Europe is facing difficult times. Governments are balancing the need for more resources with the need to maintain peace and prosperity domestically. To properly strike this balance, EU policymakers must incorporate “Fiscal Fairness” into the debate.

2 min read

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read

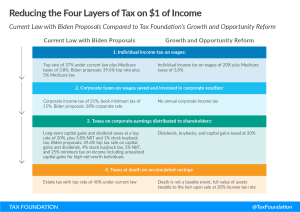

Depending on the outcome of the 2020 presidential election, we could be looking at a very different tax code in the years to come. What tax changes has former Vice President Joe Biden proposed and what would they mean for U.S. taxpayers, businesses, and the overall economy?

Taxes matter to investment decisions. Global tax collectors must weigh the marginal benefit of additional revenues against the economic harm high business taxes could cause.

19 min read