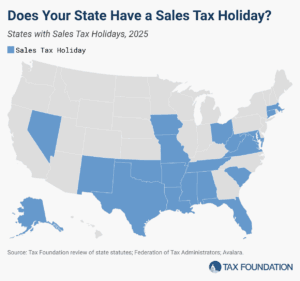

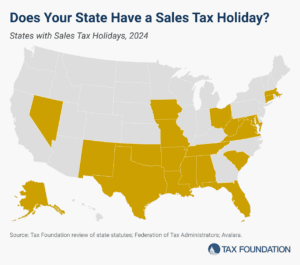

Sales Tax Holidays by State, 2025

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

16 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

16 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min read

With other states upping their game to attract ever-more-mobile people and businesses, lawmakers and the governor are not content to leave Tennessee’s business taxes in their current, uncompetitive form.

7 min read

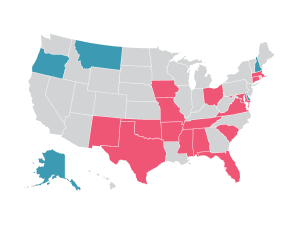

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

43 min read

Amidst soaring inflation, policymakers across the political spectrum proposed many ideas to soften the blow of higher prices–especially for low-income workers and families. One idea that caught on quickly: sales tax relief on groceries. The idea had its merits, but Tax Foundation research shows that it may have missed the mark.

The cost of gas is going up. To address this, policymakers have proposed suspending the gas tax. But could this actually make matters worse? We discuss why suspending the gas tax might be a mistake and what lawmakers could do to help with the rising costs of gas.

Although state budgets may be in unusual places this year, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

If a state must offer a “holiday” from its tax system, it is an implicit recognition that the state’s tax system is uncompetitive.

44 min read

Sales tax holidays are not sound tax policy as they create complexities for all involved, while inserting the political process into consumer decisions.

45 min read

The U.S. Supreme Court has agreed to take South Dakota v. Wayfair Inc., which could result in a ruling that settles the years-long debate over how to apply sales taxes to online retail activity.

1 min readDue in part to historical accident and also to the proliferation of exemptions, the effectiveness of the state sales tax continues to erode. The median state sales tax, which should apply to all personal consumption, is nonly applied to 23 percent of personal consumption.

25 min read

Sales tax holidays have enjoyed political success, but rather than providing a valuable tax cut or a boost to the economy, they impose serious costs on consumers and businesses without providing offsetting benefits.

40 min read