Ensuring Tax Rates Don’t Rise with Inflation

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min readExplore our research and analysis of tax policies proposed and implemented during the administration of President Ronald Reagan.

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

How do current federal individual income tax rates and brackets compare historically?

1 min read

The Tax Reform Act of 1986 extended depreciation schedules for both commercial and noncommercial of real estate, reducing the attractiveness of those investments.

21 min read

Improving cost recovery for residential structures, while not a silver bullet for solving the housing crisis, would on the margin encourage more construction that would help push rents down across the board.

4 min read

In contrast, the Tax Cuts and Jobs Act lowered the corporate tax rate and allows immediate and full expensing for the next five years.

3 min read

How do current federal corporate tax rates and brackets compare historically?

1 min read

Trump’s tariff hikes would rank as the the largest tax increase outside of wartime since 1940. Meanwhile, Harris’s tax plan would rank as the 6th largest tax increase outside of wartime since 1940.

5 min read

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

18 min read

History is clear. Lowering budget deficits via spending restraint frees resources for additional private output and jobs. Lowering them by raising taxes on business investment and labor services makes it harder to dis-inflate without a recession.

7 min read

The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

14 min read

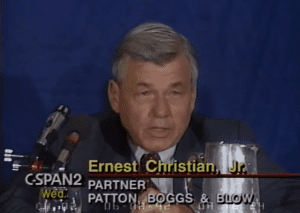

Ernest S. Christian, Jr., (1937-2022) was one of the tax policy community’s most distinguished and influential experts, showing us how effective sound tax policy can be. He passed away on September 13th, leaving behind a legacy of tax reform.

4 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

How do current federal individual income tax rates and brackets compare historically?

1 min read

While parts of the U.S. tax code can handle inflation, full expensing of capital investment would be a major improvement along these lines.

5 min read

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

The Tax Reform Act of 1986 extended depreciation schedules for both commercial and noncommercial of real estate, reducing the attractiveness of those investments.

21 min read

Improving cost recovery for residential structures, while not a silver bullet for solving the housing crisis, would on the margin encourage more construction that would help push rents down across the board.

4 min read

In contrast, the Tax Cuts and Jobs Act lowered the corporate tax rate and allows immediate and full expensing for the next five years.

3 min read

President Trump’s plan to impose tariffs on all steel and aluminum imports–except those from Mexico and Canada–will not work as the administration hopes. It will increase costs for businesses and raise prices for consumers.

3 min read