All Related Articles

Tax Options to Promote Short-Term Recovery and Long-Term Economic Growth in Wisconsin

From a revenue standpoint, Wisconsin was better off than many states going into this crisis, but the policy decisions—including tax policy decisions—state policymakers make in the months ahead will have far-reaching implications for how quickly jobs and wages are restored in Wisconsin.

7 min read

National Taxpayer Advocate’s Report Is a Road Map to Simpler Pandemic Relief Provisions

The size and scope of the tax changes within the CARES Act created significant administrative challenges for the IRS. Lawmakers should prioritize simplicity in the next round of relief.

3 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

States Should Conform to These Four CARES Act Provisions to Enhance Business Liquidity

As policymakers continue evaluating their evolving revenue and spending options, the importance of enacting policies that enhance business liquidity must remain at the forefront.

9 min read

Weighing the Benefits of Permitting Business Credit Cashouts in Phase 4 Economic Relief

As lawmakers explore options for “Phase 4” coronavirus relief legislation, one idea that has received renewed attention is allowing businesses to cash out business tax credits. This proposal would be strengthened by also permitting acceleration of firms’ accrued net operating loss (NOL) deductions and designing the proposal so that firms can quickly convert these tax assets into cash.

4 min read

Net Operating Loss Carrybacks Are a Vital Source of Tax Relief for Struggling Firms in the Coronavirus Crisis

Rather than find ways to restrict net operating loss (NOL) carrybacks, lawmakers should focus on ways to improve liquidity by cashing out accrued NOLs, which would benefit startups and new small businesses without taxable income to offset in prior years.

3 min read

Tax Changes in California Governor’s Budget Could Stand in the Way of Economic Recovery

While other states are starting to think about the recovery, California is contemplating tax policies that would stand in the way of economic expansion once the health crisis abates. California’s shortfall is all too real, but tax policies which impede recovery are a hindrance, not a help.

5 min read

HEROES Act First Bid to Provide Phase 4 Relief for Businesses and Individuals

The HEROES Act, the $3 trillion relief package proposed by House Democrats, is the first bid to provide additional phase 4 aid for businesses and individuals amid the coronavirus pandemic.

7 min read

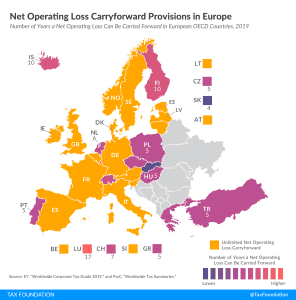

Advancing Net Operating Loss Deductions in Phase 4 Business Relief

Policymakers will have to consider design options for accelerating NOL deductions to ensure the refunds are simple, provide targeted relief to struggling firms, and are consistent with long-run revenue needs.

17 min read

A Review of Net Operating Loss Tax Provisions in the CARES Act and Next Steps for Phase 4 Relief

In addition to providing economic relief to individuals and loans to businesses struggling during the coronavirus crisis, the CARES Act changed several tax provisions to increase liquidity to ensure firms survive a large decline in cash flow.

7 min read

Norway Opens the Fiscal Toolbox

Norway passed a large coronavirus tax relief package to address layoffs and bankruptcies, which includes a reduced VAT rate, the introduction of a loss carryback provision, and targeted postponements for wealth tax payments, among other provisions.

5 min readTax Policy to Bridge the Coronavirus-Induced Economic Slowdown

Tax policy can help by giving businesses current access to future tax “assets”—deductions and credits the businesses will be allowed or owed over time any way under current law—instead of making them wait.

5 min read

Tax Options for Economic Relief During the Coronavirus Crisis

Instead of simply reaching for fiscal stimulus with the goal of increasing economic activity, tax policy changes can give vulnerable individuals and businesses additional liquidity and space to survive the reduction in economic activity needed in light of the coronavirus outbreak.

5 min read

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read

Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax

Why do some companies appear to be profitable but pay little or no federal income taxes? It’s largely due to differences between book and taxable income.

4 min read