All Related Articles

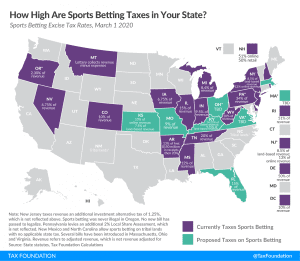

Sports Betting Will Not Solve State Budget Crises

The pandemic has left states in dire straits financially and lawmakers are getting creative in their pursuit of new revenue sources. However, it’s unlikely that revenue from sports betting will have any meaningful impact on budget shortfalls

3 min read

Sports Betting During a Pandemic

5 min read

Maryland Legislature Seeks Revenue with Risky Proposals

One notable consequence of high state tobacco excise tax rates is increased smuggling as people procure discounted products from low-tax states and sell them in high-tax states. Smugglers wouldn’t have to look far to find cheaper smokes. All of Maryland’s neighboring states have rates lower than $4 per pack, including Virginia ($1.20) and West Virginia ($0.30). Such an increase would impact the many small business owners operating vape shops around the state and convenience stores relying heavily on vapers as well as tobacco sales.

7 min read

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min read

Results of 2019 State and Local Tax Ballot Initiatives

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read

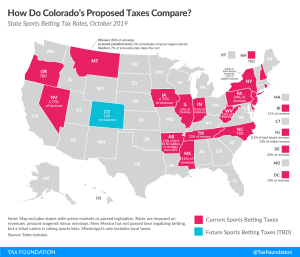

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

Mississippi Lawmakers Consider Creation of State Lottery

As Mississippi policymakers contemplate a lottery, it may be tempting to think of it as free money—new revenue raised without having to adopt a new tax. A better way of thinking about the issue, however, would recognize the lottery for what it is: a regressive form of high implicit taxation.

3 min read

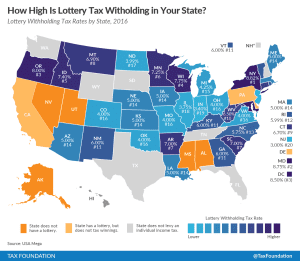

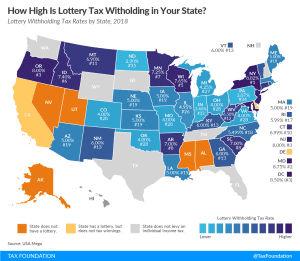

What Percentage of Lottery Winnings Would be Withheld in Your State?

You probably aren’t going to win the Powerball jackpot, but your state already has. Here’s a look at lottery withholding tax rates by state.

2 min read