How Have Federal Revenues Evolved since the Tax Cuts and Jobs Act?

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read

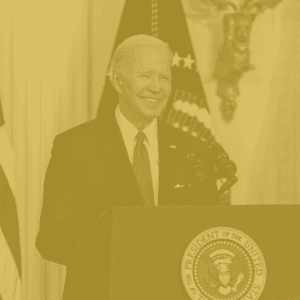

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

The government won in Moore. However, given the narrow opinion of the court and the reasoning in the Barrett concurrence and the Thomas dissent, it seems likely that future rulings under other facts and circumstances could favor taxpayers instead.

7 min read

Tariffs are a hot topic this election cycle for both President Biden and former President Trump. But why are tariffs so popular despite their economic downsides?

The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

18 min read

Calling the latest round of tariffs “strategic” does not change the underlying reality: these policies are just another form of protectionism, and therefore, subject to all the same economic problems.

4 min read

Trump’s protectionist measures and the continuation of most of them under the Biden administration already form the matrix of American trade policy after the 2024 elections.

If reelected, President Trump would drastically escalate the trade war he started during his first term. But what often goes unnoticed is President Biden’s role in continuing Trump’s first trade war. In fact, more tax revenue from the trade war tariffs has been collected under Biden than under Trump.

5 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

In the context of the 2024 election year, what does President Biden’s 2025 budget proposal signify regarding his strategies and priorities as he seeks reelection? And how could these proposals shape the overall landscape of this election cycle?

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

What does it mean to be an American company?

4 min read

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

The uncertain future of American finances in a time of potential economic instability points to the need for tax reforms that encourage individuals to save and build financial security in a relatively simple way, such as through universal savings accounts.

6 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

Bond markets are screaming for a return to deficit reduction politics. Unfortunately, most policymakers are failing to listen to what the markets are telling them.

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

5 min read