A Regulatory Tax Hike on U.S. Multinationals

While much of the policy focus has been on proposals embedded in the Build Back Better agenda, a meaningful tax hike for multinational companies has already been adopted.

1 min read

While much of the policy focus has been on proposals embedded in the Build Back Better agenda, a meaningful tax hike for multinational companies has already been adopted.

1 min read

One goal for the Build Back Better Act has been to increase the amount of revenue the U.S. raises from U.S. companies at home or abroad. With the global minimum tax rules in play, it is likely that the expected gains to the U.S. Treasury from foreign profits of U.S. companies will diminish.

5 min read

The current prospect for the global minimum tax requires the attention of U.S. lawmakers. Otherwise, a tax benefit at home will just mean a tax increase abroad.

6 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

As 2021 comes to a close, countries are moving toward harmonizing tax rules for multinationals, but stalled talks on the Build Back Better Act in the United States means new uncertainties for a global agreement and for taxpayers.

5 min read

Policymakers and taxpayers should understand the scope of tax changes necessary to fully pay for the large-scale social spending programs that would be initiated under the Build Back Better Act.

6 min read

As the Senate weighs changes to the spending and tax portions of the Build Back Better Act, the Congressional Budget Office (CBO) and Tax Foundation find the bill would increase the cumulative budget deficit over the next 10 years—contrary to claims the legislation is “fully paid for.”

4 min read

As Congress contemplates adding a new worldwide interest limitation rule as part of the House Build Back Better Act, it is useful to consider the potential effects of this proposal as well as whether it is necessary to add this on top of the U.S.’s existing restrictions on the value of interest deductions.

9 min read

While the book minimum tax is smaller in scale than the proposed original corporate rate increases, it would introduce more complexity, inefficiency, and problems at the industry- and sector-levels that a corporate rate increase would not. Neither option is an optimal way to raise new tax revenues.

4 min readLearn more about the House Build Back Better Act, including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals.

15 min read

Senior policy analyst Garrett Watson joins host Jesse Solis to discuss the Build Back Better Act’s prospects and what tax changes—ranging from the SALT deduction to the Child Tax Credit—could change in order to gain enough support for passage.

The persistently high inflation in recent months has made some lawmakers question the need for additional deficit spending, In the short term, the Build Back Better Act would likely contribute to inflation, but the magnitude of that contribution is unclear.

3 min read

The Build Back Better Act would raise taxes to pay for social spending programs. But the design of some of the tax increases may end up hurting private pensions, among other problems.

6 min read

One unintended consequence of the tax proposals in the Build Back Better Act is a higher potential burden on wireless spectrum investments, which could slow the build out of 5G technology as the U.S. races to compete with other countries—moving in the opposite direction of countries like China that are actively subsidizing 5G expansion.

5 min read

Due to the House Build Back Better tax plan’s economically costly and inefficient tax increases, our analysis finds that long-run GDP would drop by a little over $1 for every $1 in new tax revenue.

6 min read

Infrastructure has made its way across the finish line, but the tax debate is far from over on Capitol Hill. Senior policy analyst Garrett Watson joins host Jesse Solis to walk us through the latest iteration of Democrats’ trillion-dollar reconciliation package and the myriad tax changes that are being proposed to finance this deal.

The most recent versions of President Biden’s Build Back Better plan are improvements on the original proposal, but would still reduce economic growth and average after-tax incomes for the top 80 percent of earners in the long run.

7 min read

The nicotine tax proposal in the Build Back Better Act neglects sound excise tax policy design and by doing so risks harming public health. Lawmakers should reconsider this approach to nicotine taxation.

8 min read

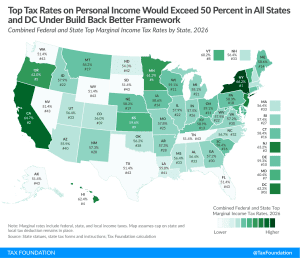

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD).

2 min read

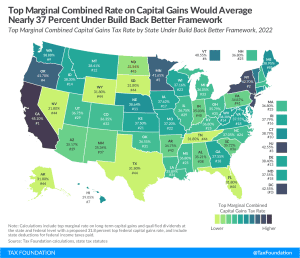

Under the Build Back Better framework, six states and D.C. would face combined top marginal capital gains tax rates of more than 40 percent, nearing the top rate among OECD countries.

3 min read