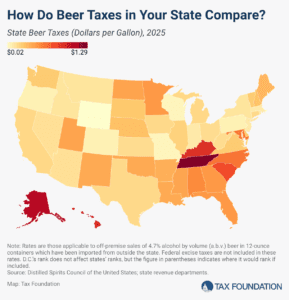

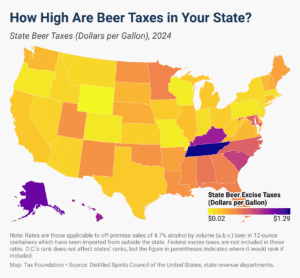

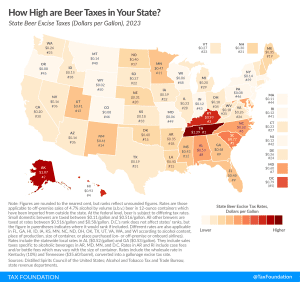

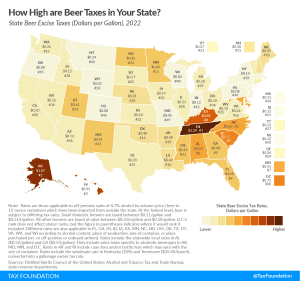

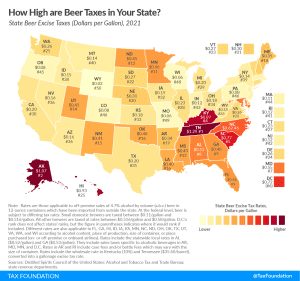

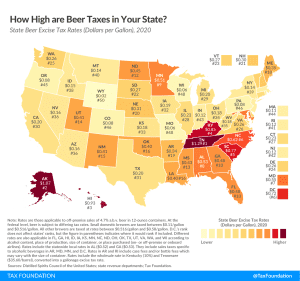

Beer Taxes by State, 2025

In the United States, taxes are the single most expensive ingredient in beer. The tax burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

6 min read