Why Neutral Cost Recovery Matters

Allowing full deductibility of residential structures would mean more housing construction, particularly multifamily housing—a practical solution to address housing affordability challenges.

6 min readReforming the low-income housing tax credit (LIHTC) and providing neutral cost recovery for residential structures would tackle the problem of housing affordability in a complementary fashion. Neutral cost recovery expands housing supply and lowers costs of construction and rents, which can help LIHTC fund more below-market-rate projects.

These reforms are two important steps that policymakers can take to ensure the federal tax code is not a barrier to solving America’s affordable housing challenge.

Allowing full deductibility of residential structures would mean more housing construction, particularly multifamily housing—a practical solution to address housing affordability challenges.

6 min read

Reforming the Low-Income Housing Tax Credit (LIHTC) and providing neutral cost recovery for residential structures would tackle the problem of housing affordability in a complementary fashion.

Affordable housing is an issue that has had long-standing bipartisan interest in D.C. But the path to increase the supply of affordable housing, though often well-intentioned, has created a bureaucratic nightmare.

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

The Tax Reform Act of 1986 extended depreciation schedules for both commercial and noncommercial of real estate, reducing the attractiveness of those investments.

21 min read

Improving cost recovery for residential structures, while not a silver bullet for solving the housing crisis, would on the margin encourage more construction that would help push rents down across the board.

4 min read

In a perilous economic and fiscal environment, with instability created by Trump’s trade war and publicly held debt on track to surpass the highest levels ever recorded within five years, a lot rides on how Republicans navigate tax and spending reforms in reconciliation.

6 min read

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

Policymakers can and should address taxpayers’ legitimate grievances about out-of-control property tax bills, but they should do so without upending a system of taxation that is more efficient, fair, and pro-growth, and better suited to municipal finance, than any of the alternatives.

39 min read

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

Georgia should focus on policies that restrict the overall growth of property taxes, not policies that functionally freeze property taxes for current owners by shifting costs onto new owners and into the sales tax.

6 min read

Allowing full deductibility of residential structures would mean more housing construction, particularly multifamily housing—a practical solution to address housing affordability challenges.

6 min read

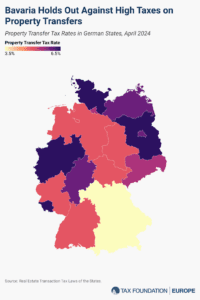

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

Portland residents face some of the country’s highest taxes on just about every class of income. In an era of dramatically increased mobility for individuals and businesses alike, that’s not a recipe for success.

11 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

Federal spending, deficits, and debt are at unsustainable levels. The proposed federal budget is laden with redundant programs, obsolete programs, corporate welfare, and nationalized industries. As Congress begins to craft the FY 2024 federal budget, it needs to establish a process of systematically reviewing programs and priorities.

Affordable housing is an issue that has had long-standing bipartisan interest in D.C. But the path to increase the supply of affordable housing, though often well-intentioned, has created a bureaucratic nightmare.

Reforming the Low-Income Housing Tax Credit (LIHTC) and providing neutral cost recovery for residential structures would tackle the problem of housing affordability in a complementary fashion.

Policymakers actively marginalized the manufacturing sector by saddling them with cost recovery rules that prevent them from deducting the full cost of investment in physical plant and equipment. Going forward, policymakers should avoid haphazard fixes, targeted measures, and protectionism.

50 min read

Congressional lawmakers are putting together a reconciliation bill to enact much of President Biden’s Build Back Better agenda. Many lawmakers including Senate Finance Committee Chair Ron Wyden (D-OR), however, want to make their own mark on the legislation.

5 min read

To tackle problems of homelessness and housing costs, Senator Ron Wyden (D-OR) has released a major tax proposal, the Decent Affordable Safe Housing (DASH) For All Act. Several of Wyden’s proposals are also components of the Biden administration’s infrastructure agenda, with a large focus on tax credits designed to either incentivize new housing or directly reduce rent burdens.

5 min read

While President Biden has many proposals aimed at increasing the supply of affordable housing, including tax credits, his plans to raise business taxes could hinder that goal.

4 min read