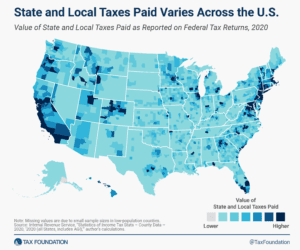

A More Generous SALT Deduction Cap in the Big, Beautiful Bill Would Cost Revenue and Primarily Benefit High Earners

Letting the SALT cap slip further upwards would undercut the TCJA’s long-term legacy, worsening the fiscal outlook of the tax package and providing an unneeded benefit to higher earners.

4 min read