Risks to Worldwide Investment as Capital Allowances Began to Phase Out in 2023

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

5 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

5 min read

The policy will likely raise GDP by 0.9 percent, investment by 1.5 percent, and wages by 0.8 percent, relative to a return to the pre-2021 law.

3 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

The Small Business Jobs Act would improve the tax treatment of investment but the proposal stops short of full expensing, leaving room for improvement.

3 min read

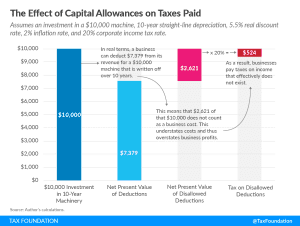

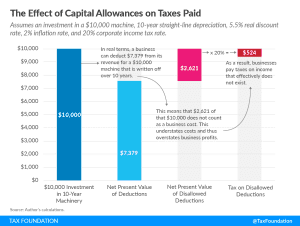

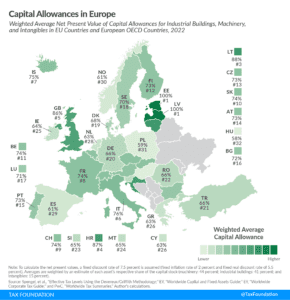

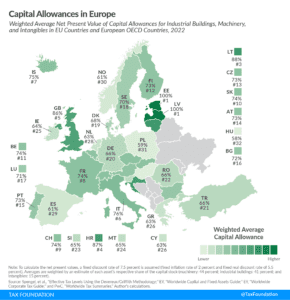

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

6 min read

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

A recently enacted bill in Mississippi made the Magnolia State only the second state in the country to make full expensing permanent. The bill joins reductions to the individual income tax and capital stock tax rates, already in progress, as model, pro-growth reforms for the region.

5 min read

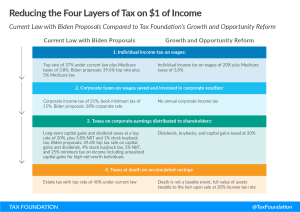

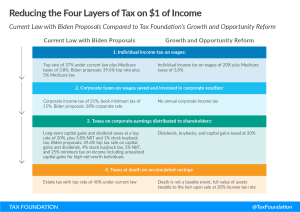

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

5 min read

The tax treatment of research and development (R&D) expenses is one of the biggest issues facing Congress as the year winds down.

4 min read

We find that the dynamic cost of permanent bonus depreciation rises by about 7 percent under 4 percent inflation, but the economic benefit, measured by the size of the economy, rises by about 25 percent.

4 min read

The phaseout of 100 percent bonus depreciation, scheduled to take place after the end of 2022, will increase the after-tax cost of investment in the U.S. Permanently extending it would increase long-run economic output by 0.4 percent and increase employment by 73,000 FTE jobs.

20 min read

The Senate has begun debate on the so-called Chips bill, which would provide $52 billion in grants and $24 billion in tax credits to supposedly strengthen the production of semiconductors in the U.S.

3 min read

Policymakers should continue to focus on longer term impacts rather than emphasizing the short-term stimulus effects of tax cuts.

3 min read