Shaky Economic and Fiscal Outlook Requires Stable and Pro-Growth Tax Extenders Policy

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

The House of Representatives is set to pass the Inflation Reduction Act, the latest iteration of President Biden’s tax and climate agenda. Garrett Watson joins Jesse to discuss what sacrifices were made by key lawmakers to bring this bill to the finish line. They also look at what the economic impact of this proposal would be as the country continues to face historic rates of inflation.

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

How will the Inflation Reduction Act taxes impact inflation, economic growth, tax revenue, and everyday taxpayers? See Inflation Reduction Act tax changes.

12 min read

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

The Inflation Reduction Act may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution.

4 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. tax rules for large companies. However, as proposals have been debated in recent months, there are have been clear divides between U.S. proposals and the global minimum tax rules.

6 min read

Academic research indicates foreign direct investment (FDI) is highly responsive to the corporate effective tax rate (ETRs); that is, the tax rate after accounting for all deduction and credits available to corporations.

3 min read

While the bulk of the proposed tax increases and spending programs remain under debate, Democratic lawmakers have reportedly agreed on prescription drug pricing provisions as a starting point for a revived Build Back Better package.

3 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

27 min read

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

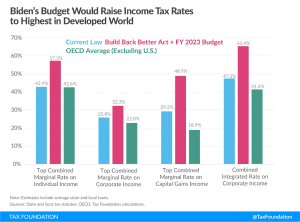

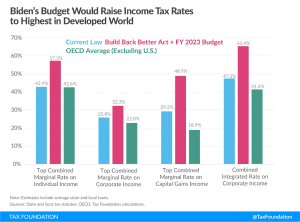

President Biden’s budget proposes several new tax increases on high-income individuals and businesses, which combined with the Build Back Better plan would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

5 min read

Starting this year, firms must amortize their research and development (R&D) expenses over five years rather than immediately deduct them from taxable income, a policy change designed to raise federal tax revenue in the short term.

4 min read

Federal policymakers are debating a legislative package focused on boosting U.S. competitiveness vis-a-vis China; however, it currently contains little to no improvements to the U.S. tax code.

34 min read

Government-set pricing of prescription drugs is not a fix for today’s rampant inflation and further, it would give rise to new problems of its own.

6 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

The FY 2023 budget proposes several new tax increases, which in combination with the Build Back Better Act, would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

4 min read

Biden’s proposal would impose a complicated never been tried before tax, adding new compliance and administrative challenges for an already overburdened IRS while weakening the U.S. economy by raising the tax burden on U.S. saving and entrepreneurship.

6 min read