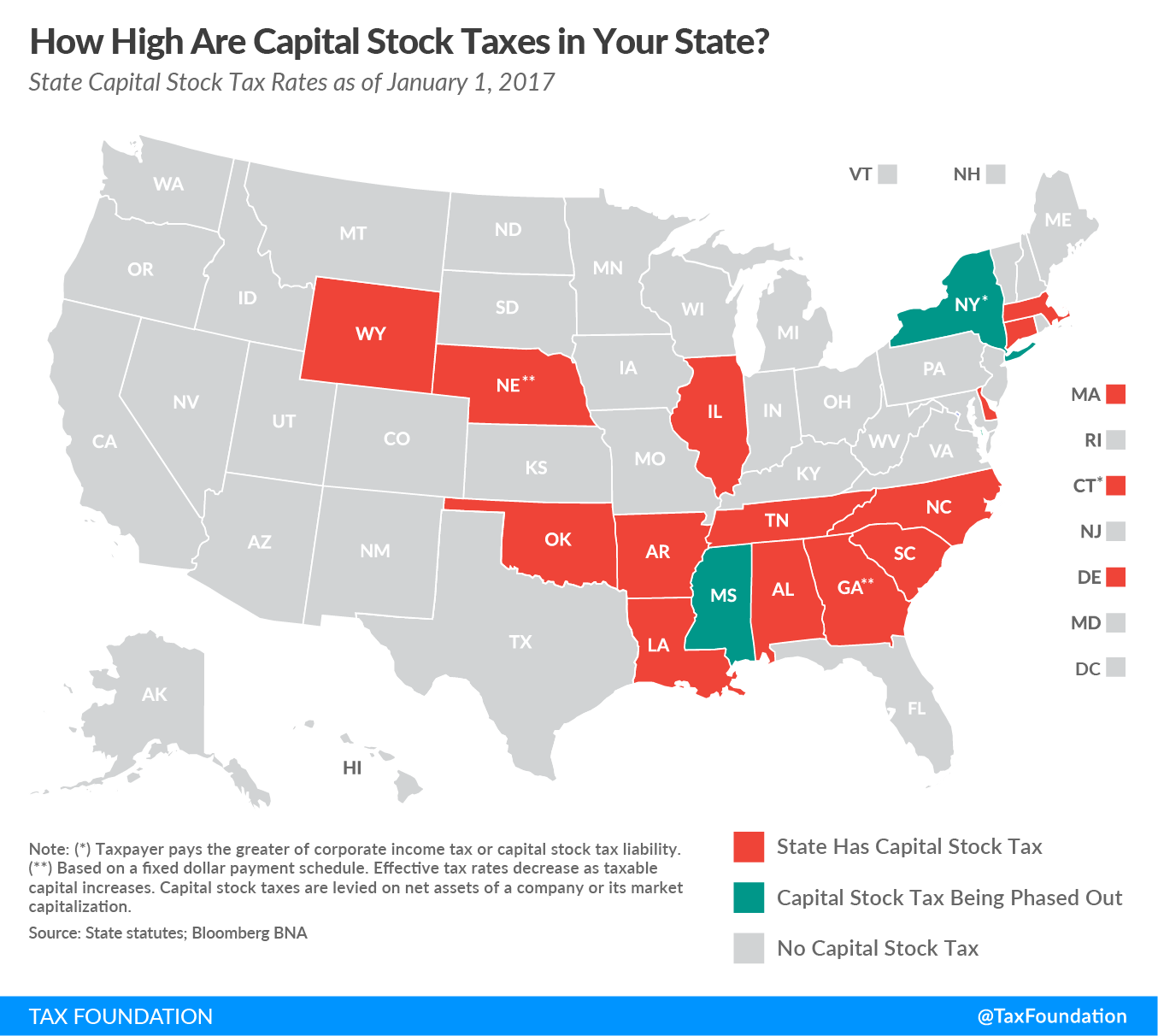

Only 16 states levy a capital stock tax, a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on the net worth of a business. These taxes are often levied at a low percentage on the wealth of a firm. Because the tax is paid in good times and bad, businesses often find themselves using precious cash flow to pay it. In broad economic terms, capital stock taxes (referred to as franchise taxes in many states) are destructive because they disincentivize the accumulation of additional wealth, or capital, which distorts the size of firms.

In most cases, the capital stock tax is levied as a percentage of the base (net assets). The rates range from a high of 0.37 percent in Connecticut to a low of 0.02 percent in Wyoming. Of the 16 states levying such taxes, only eight cap the maximum amount a business can pay. The lowest of these caps is in Georgia with a maximum payment of $5,000. Georgia’s tax is a bit different from other states in that it’s based on a fixed dollar payment schedule, rather than a percentage of the tax base. Nebraska’s tax also functions in this way. In several states, the capital stock functions somewhat as an alternative minimum tax, where firms pay the greater of either corporate income tax or capital stock tax liability (the case in Connecticut and New York).

Legislators have come to realize the damaging effects of capital stock taxes, and a handful of states are reducing or repealing them. Kansas completed the phaseout of its tax in 2011. West Virginia and Rhode Island fully phased out their capital stock taxes as of January 1, 2015, and Pennsylvania phased out its capital stock tax in 2016. Mississippi will phase out its capital stock tax by 2027 and New York’s will phase out by 2021.

| State | Tax Rate | Max Payment |

|---|---|---|

| (a) Taxpayer pays the greater of corporate income tax or capital stock tax liability. | ||

| (b) Based on a fixed dollar payment schedule. Effective tax rates decrease as taxable capital increases. | ||

| (c) Tax is being phased out; liability limited to liability in tax year ending Dec. 31, 2010 | ||

| (d) Tax will be fully phased out by 2027. | ||

| Ala. | 0.175% | $15,000 |

| Ark. | 0.300% | Unlimited |

| Conn. (a) | 0.310% | $1,000,000 |

| Del. | 0.035% | $180,000 |

| Ga. | (b) | $5,000 |

| Ill. | 0.100% | $2,000,000 |

| La. | 0.300% | Unlimited |

| Mass. | 0.260% | Unlimited |

| Miss. (d) | 0.250% | Unlimited |

| Nebr. | (b) | $11,995 |

| N.Y. (a,c) | 0.100% | $5,000,000 |

| N.C. | 0.150% | Unlimited |

| Okla. | 0.125% | $20,000 |

| S.C. | 0.100% | Unlimited |

| Tenn. | 0.250% | Unlimited |

| Wyo. | 0.020% | Unlimited |