On October 11, the Spanish government published its draft budget proposal for 2019. In general, the proposed budget shows that the government is planning to both taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. and spend a bit more in 2019 relative to 2018 levels. Unfortunately, tax policies in the proposed budget would be harmful and hurt Spain’s competitiveness while introducing more complexity to its tax system.

The main proposals for business taxation include:

- A 3 percent tax on digital services modeled after the European Commission proposal, which has been broadly criticized

- A special lower corporate tax rate of 23 percent for businesses with less than €1 million ($1.15 million) in revenues; the headline corporate tax rate would remain at 25 percent.

- A financial transaction tax of 0.2 percent levied on sales of shares of Spanish-listed companies with market capitalization above €1 billion ($1.15 billion)

- Reducing the territoriality of the Spanish international tax provisions by lowering the exemption on foreign capital gains and dividends to 95 percent from the previous 100 percent

On personal income, the proposals include:

- Increasing personal income tax rates by 2 percent for income above €130,000 ($150,332) and by four percentage points for income above €300,000 ($346,920)

- Raising taxes on capital gains by four percentage points for income above €140,000 ($162,280)

- Increasing wealth taxes for estates valued over €10 million ($11.5 million)

Though not all the proposals can be accounted for in the Tax Foundation’s 2018 International Tax Competitiveness Index, the impact of the financial transaction tax, territorial provisions, individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , and capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. changes can be evaluated using the Index.

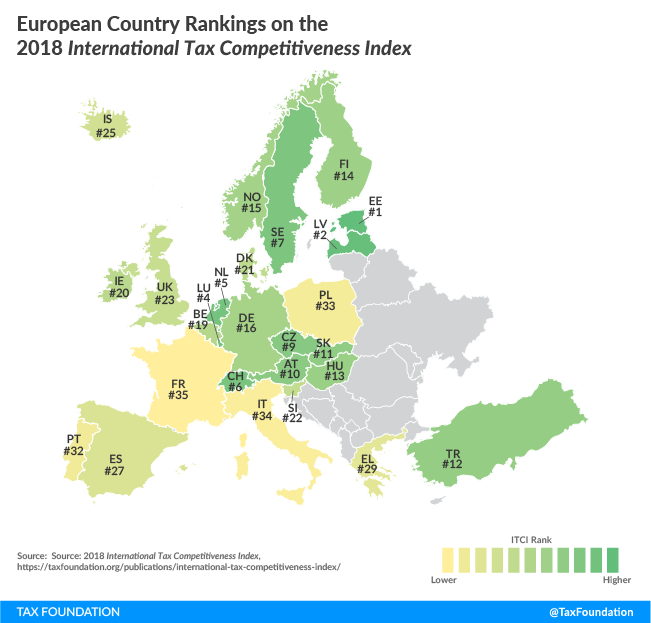

Spain ranks 27th overall on the 2018 Index, one spot down from 2017. Spain ranks better than its neighbors France (35th) and Portugal (32nd) but has a lower ranking compared to many other countries in Europe.

[global_newsletter_inline_widget campaign=”//TaxFoundation.us1.list-manage.com/subscribe/post?u=fefb55dc846b4d629857464f8&id=6c6b782bd7&SIGNUP=ITCI”]

If the proposed tax changes were to be adopted and no other country changed its policies, Spain would drop one spot from 27th overall to 28th. It would be the third consecutive year that Spain would have fallen in ranking on the Index.

Instead of pursuing more harmful tax policies, the Spanish government could adopt pro-growth policies by improving provisions that allow businesses to write off the costs of their investments in buildings and machinery. Spain could also reduce the tax burden on labor to improve market incentives to work and hire. And though a corporate rate cut for small businesses would likely be valuable to the businesses targeted by that tax cut, a better policy would be to minimize the distortions of having multiple corporate rates and lower marginal rates faced by all businesses.

Spain’s value-added tax (VAT) is also ripe for reform. Ideally, a VAT should be levied on all final consumption. However, in Spain the VAT rate of 21 percent applies to just 41 percent of consumption. This reflects both Spain’s VAT gap (lack of compliance with the VAT) and exemptions or special lower rates for certain classes of goods. The narrow tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. essentially requires a higher VAT rate than would otherwise be necessary to raise the same amount of revenue if there were fewer exemptions.

As many countries around the world pursue tax reforms that will improve their growth potential, benefit their workers, and raise revenue in a more neutral manner, Spain is moving in the opposite direction.

Share