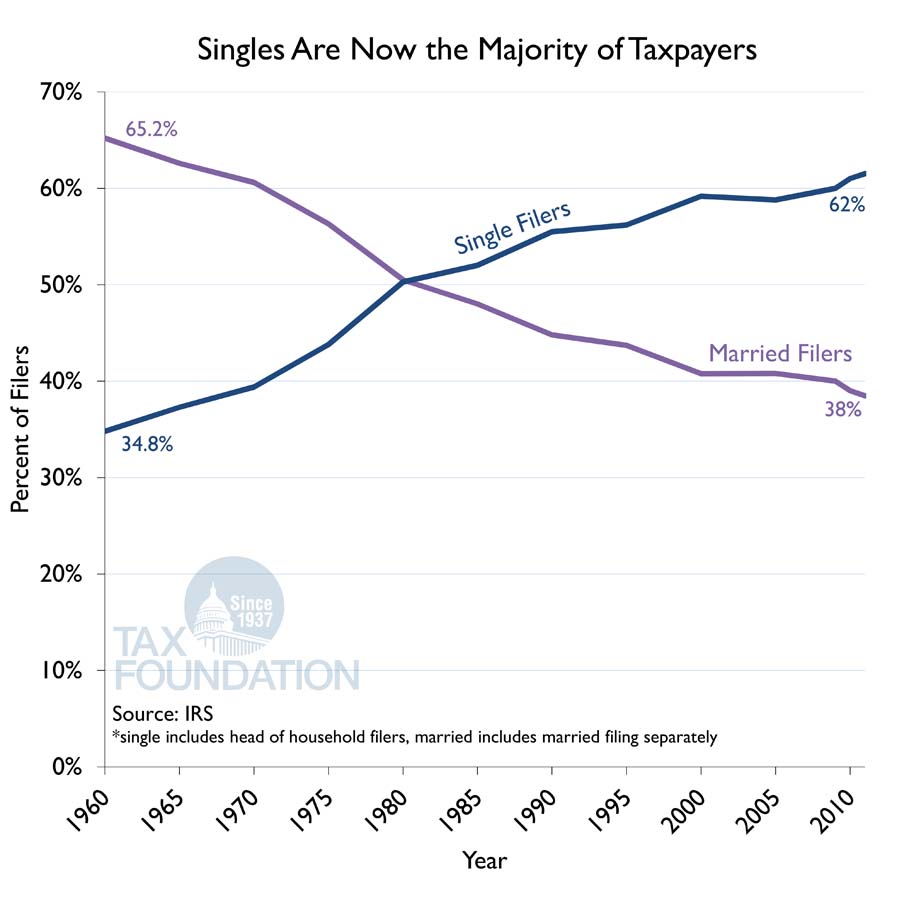

When we used to think of middle class families, we thought of married couples with children such as June and Ward Cleaver from Leave It to Beaver. Once upon a time, June and Ward represented most taxpayers, but demographic changes have made those notions obsolete. In 1960, more than 65 percent of taxpayers were married couples, while single filers comprised the remaining 35 percent. Those figures are now nearly reversed. Because the majority of taxpayers today are single filers, the typical taxpayer looks more like Phoebe and Joey from Friends. As a result, lawmakers’ efforts to use taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy to help middle-income taxpayers are now missing their targets.

For more charts like the one below, see the second edition of our chart book, Putting a Face on America's Tax Returns.

Share this article