All Related Articles

A Bittersweet Broadcast

On this “not-so-heavy-on-the-policy” episode, our much-beloved host, Jesse Solis, is joined by the Deduction’s Senior Producer, Dan Carvajal, and Marketing Associate, Kyle Hulehan, to share some bittersweet news.

Repealing Inflation Reduction Act’s Energy Credits Would Raise $663 Billion, JCT Projects

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

Oklahoma Adopts Franchise Tax Repeal, Eliminates Marriage Penalty

In the closing days of the 2023 legislative session, Oklahoma lawmakers repealed the state’s corporate franchise tax and eliminated the marriage penalty in its individual income tax. Both tax changes represent a positive step forward for the state.

4 min read

Enhancing the U.S. Tax Treaty Network: Prioritizing Brazil and Chile

The National Foreign Trade Council’s survey shows that the private sector recognizes the economic value of treaties as an instrument to increase tax certainty and decrease distortions.

4 min read

Why Congress Is More to Blame than IRS for $26 Billion in Refundable Tax Credit Overpayments

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

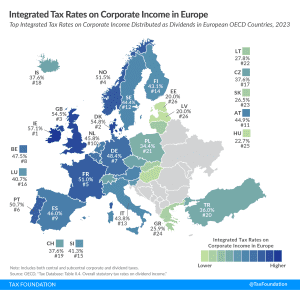

Integrated Tax Rates on Corporate Income in Europe, 2023

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

R&D Amortization Hurts Economic Growth, Growth Industries, and Small Businesses

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

Why Does the UTPR Matter?

As the UTPR is a new concept, it is worth explaining what it is and why Rep. Smith cares about it. In a sentence, the Undertaxed Profits Rule (UTPR) is a looming extraterritorial enforcement mechanism for a tax base the U.S. has not adopted.

6 min read