Space Race and the Cost of Industrial Policy

Project Apollo achieved its clear objective to put a man on the moon. But not all government spending projects are so simple (that is, if you consider flying a spaceship to the moon simple).

3 min read

Project Apollo achieved its clear objective to put a man on the moon. But not all government spending projects are so simple (that is, if you consider flying a spaceship to the moon simple).

3 min read

“No tax on tips” might be a catchy idea on the campaign trail. But it could create plenty of headaches, from figuring out tips on previously untipped services to an unexpectedly large loss of federal revenue.

6 min read

Gov. Pillen is searching for tax burden relief. But his plan, which reportedly involves a two-tiered sales tax and the state’s assumption of most school funding responsibility, would have profound implications that even those most convinced of the urgency of property tax relief may find unworkable and unpalatable.

12 min read

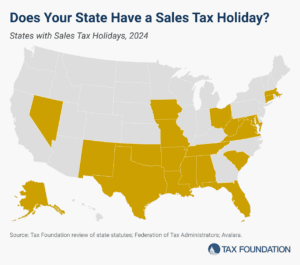

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min read

An ideal sales tax is imposed on all final consumption, both goods and services, but excludes intermediate transactions to avoid tax pyramiding.

15 min read

A 15 percent corporate rate would be pro-growth, but it would not address the structural issues with today’s corporate tax base.

4 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

A higher tax burden for private infrastructure investments like wireless spectrum, 5G technology, and machinery and equipment makes an existing problem worse—especially against the backdrop of outright state subsidies in countries like China.

6 min read

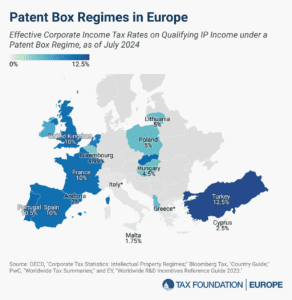

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read