All Related Articles

9225 Results

Business Investment Increases by 39 Percent in Q1 2018

Several S&P 500 companies reported an increase in capital expenditures, a possible sign that the Tax Cuts and Jobs Act will help encourage new investment.

2 min read

Reforming Arkansas’s Income Taxes

1 min read

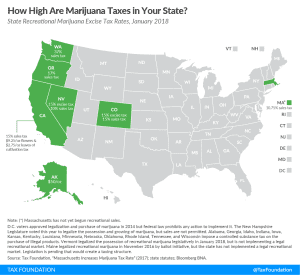

Recreational Marijuana Taxes by State, 2018

As public opinion increasingly favors the legalization of recreational marijuana, a growing number of states must determine how to structure marijuana taxes.

3 min read