All Related Articles

What to Expect from IRS Guidance on SALT Deduction Cap Workarounds

While a few are hoping for a different outcome, most observers expect the IRS to disallow these new, intentional SALT workarounds that have been adopted by New York and a handful of other states.

7 min read

Reviewing Different Methods of Calculating Tax Compliance Costs

Tax compliance creates real costs, which can be calculated. Each method provides unique illustrations of the cost of complying with U.S. tax code.

11 min readResponding to the NYT’s Stock Buybacks Analysis

The increase in stock buybacks isn’t surprising nor a sign that the Tax Cuts and Jobs Act won’t increase domestic investment.

2 min read

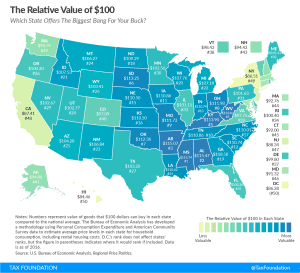

Real Value of $100 by State, 2018

4 min read

Lowering the Corporate Income Tax Rate Benefits Old and New Capital

Cutting the corporate tax rate improves the United States’ international tax competitiveness, incentives new investment and benefits both old & new capital.

3 min read

State Tax Implications of Federal Tax Reform in Virginia

Virginia has an opportunity to improve its tax competitiveness following the Tax Cuts and Jobs Act. Inaction will result in higher taxes.

14 min read

The Benefits of Cutting the Corporate Income Tax Rate

The Tax Cuts and Jobs Act reduced the corporate income tax rate from the highest statutory rate in the developed world to a more globally competitive 21 percent.

13 min read