Wartime Taxes Are Waging War on Sound Policy Choices

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

Neither presidential candidate has a perfect tax plan. But what changes could Trump and Harris make to their respective tax plans to better serve American workers and the economy? In this episode, we dissect their plans and provide practical solutions for improvement.

Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy.

44 min read

The Brazilian government is poised to make the biggest change to its alcohol tax policy in recent history.

6 min read

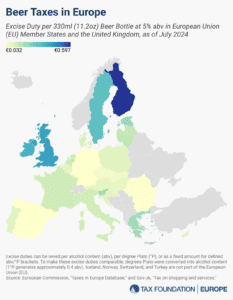

As Oktoberfest celebrations wrap up across the continent, now is a great time to examine beer taxes in the European Union. Hefty beer taxes add to the price of every drink consumed.

5 min read

Due to the peculiar design of the proposed tax increase, it’s true: the largest tax increase Oregon has ever seen would create a substantial budget shortfall.

8 min read

Especially for a state that relies so heavily on the sales tax as a source of revenue—and where most people want to keep it that way—a broad base and a low rate is crucial.

5 min read

By 2035, Social Security as we know it will largely be insolvent. If we want to fix the issue, it’s time for our parties’ leaders to reform the program so it can be around for the long run for all Americans.