All Related Articles

9225 Results

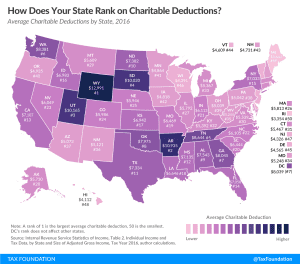

Charitable Deductions by State

2 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

The Tax Cuts and Jobs Act After A Year

5 min read

Unequal Tax Treatment Is Contributing to Rising Debt Levels for Entrepreneurs

A recent paper discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades.

3 min read