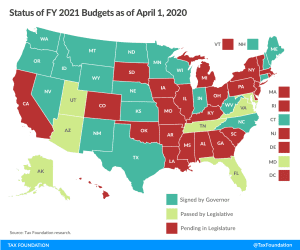

State Strategies for Closing FY 2020 with a Balanced Budget

State options for closing FY 2020 shortfalls are limited and may ultimately include drawing on reserve funds and even accounting tricks

16 min read

State options for closing FY 2020 shortfalls are limited and may ultimately include drawing on reserve funds and even accounting tricks

16 min read

Another 1.4 million Americans filed initial regular unemployment benefit claims, the eleventh week of a decline in the rate of new claims, but still among the highest levels in U.S. history. The total number of new and continued claims now stands at 19.3 million, a marked decline from the peak of 24.9 million a month ago.

7 min read

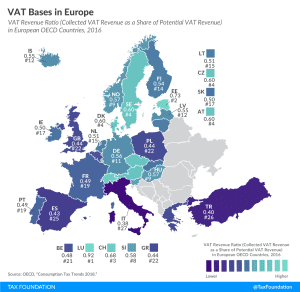

The extent to which businesses and consumers will benefit from coronavirus relief measures like temporary VAT changes will depend on the VAT base.

2 min read

Every state with an individual income tax has made some adjustment to its filing or payment deadlines, but three—Idaho, Mississippi, and Virginia—have not followed the federal government’s date of July 15th or later.

3 min read

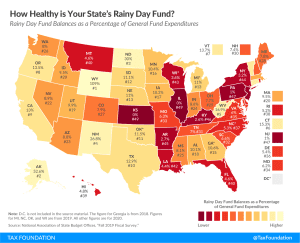

Rainy day funds have increasingly emerged as a standard component of states’ budgeting toolkits. Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund.

2 min read

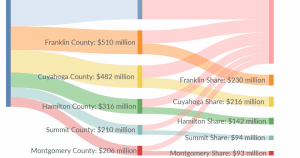

State and local governments across the country split $150 billion in federal aid under a provision of the Coronavirus Aid, Relief and Economic Security (CARES) Act, passed on March 30th.

7 min read

As Congress and the White House consider ways to shore up the economy in the face of a public health crisis, President Trump has suggested suspending the entire payroll tax for the duration of the year. That would cost about $950 billion, according to our analysis.

6 min read

House Speaker Nancy Pelosi (D-CA) has suggested that a retroactive repeal of the cap on State and Local Tax (SALT) deductions should be included in any future stimulus plans.

3 min read

Fewer people driving means fewer people buying gasoline, which may have positive effects on air pollution but could be detrimental to motor fuel excise tax revenue for federal and state governments.

4 min read

New Jersey is temporarily waiving corporate nexus arising from employees teleworking due to the COVID-19 pandemic—a response to the crisis that other states should follow.

3 min read