How Do Governments Raise Revenue?

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Our animated explainer videos are designed for the classroom, social media, and anyone looking to boost their tax knowledge on the go.

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

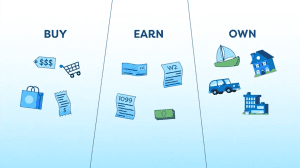

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.

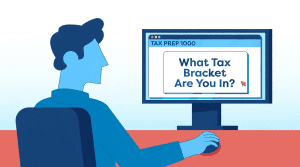

Understanding how tax brackets work can inform decisions about performing extra work through a second job or overtime, or pursuing new streams of income.

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

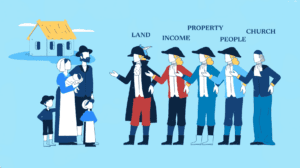

The French Revolution provides insight into the relationship between a government and its citizens and serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

Taxes have played a major role throughout history, and even date back to around 5,000 years ago. Taxes will continue to affect our lives and shape our societies just like they have for thousands of years.

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

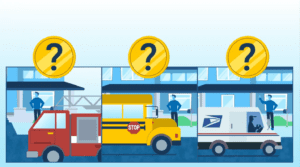

Discover why there are better and worse ways for governments to raise a dollar of revenue. That’s because no two taxes impact the economy the same.

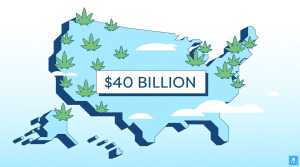

Taxing cannabis is brand-new territory. While many states see recreational cannabis as a potential gold mine for tax revenue, the reality of designing a new tax is more complicated.

Understanding how tax brackets work can inform decisions about performing extra work through a second job or overtime, or pursuing new streams of income.

Even though tariffs are invisible, their effects clearly are not. They might be sold as a tool to strengthen the economy, but tariffs are just taxes that make everyone worse off.