New Tariff Plan Could Cost States $9 Billion

While the burden of Trump’s tariffs will ultimately be felt by most U.S. consumers, two-thirds of the new taxes will be initially borne by 10 states.

6 min read

While the burden of Trump’s tariffs will ultimately be felt by most U.S. consumers, two-thirds of the new taxes will be initially borne by 10 states.

6 min read

Individual income tax rates and brackets vary widely by state. Keep track of top marginal income tax rates in your state and others with our new guide.

4 min read

Taxpayers reported $10.4 trillion of total income on their 2015 tax returns. This report breaks down the sources of this income: wages and salaries, business income, investment income, and retirement income.

9 min read

In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate.

11 min read

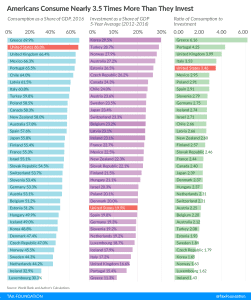

Recent data show that Americans stand out for consuming much more than they invest, and this is due in part to the tax code’s bias against savings.

3 min read

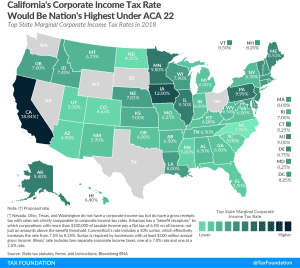

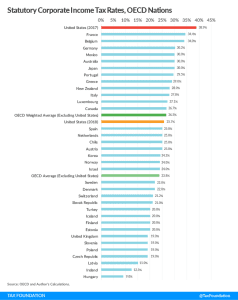

The Tax Cuts and Jobs Act significantly reduced the federal statutory corporate income tax rate. When combined with state and local taxes, it put the U.S.’s corporate tax rate in line with the average among OECD nations.

4 min read

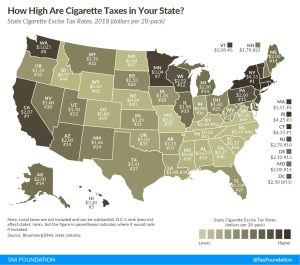

State corporate income tax rates range from 3 percent in North Carolina to 12 percent in Iowa. Download and compare each state’s 2018 rates and brackets here.

6 min read