All Related Articles

1301 Results

State-by-State Job Impacts of the Tax Cuts and Jobs Act in 2018

Our updated analysis of the state-by-state impact of the Tax Cuts and Jobs Act shows that the new federal tax law will create 215,000 full-time equivalent jobs in 2018. Here’s how each state will be affected.

2 min read

Sales Tax Holidays by State, 2018

Sales tax holidays are not sound tax policy as they create complexities for all involved, while inserting the political process into consumer decisions.

45 min read

Sales Taxes on Soda, Candy, and Other Groceries, 2018

When policymakers get in the habit of handpicking goods for which the sales tax does or does not apply, the tax base simultaneously erodes and becomes more complex.

25 min read

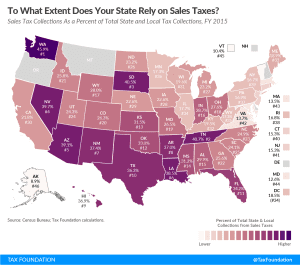

To What Extent Does Your State Rely on Sales Taxes?

Sales taxes represent a major source of state and local revenue. Click to see how much your state relies on sales taxes and for a state-by-state comparison.

3 min read