All Related Articles

1306 Results

2019 Tax Brackets

The IRS recently released its 2019 individual income tax brackets and rates. Check out the new standard deduction, child tax credit, earned income tax credit, rates and brackets, and more.

5 min read

Corporate Tax Rates Around the World, 2018

Since 1980, the worldwide average statutory corporate tax rate has consistently decreased as countries have realized the negative impact that corporate taxes have on business investment decisions.

11 min read

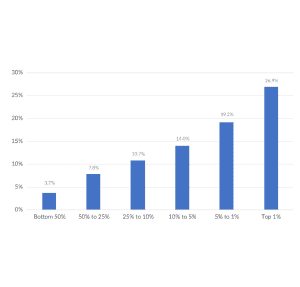

Summary of the Latest Federal Income Tax Data, 2018 Update

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read

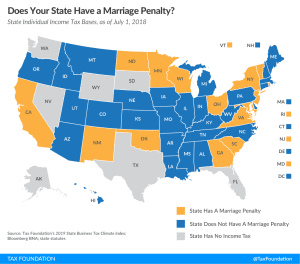

Does Your State Have a Marriage Penalty?

1 min read