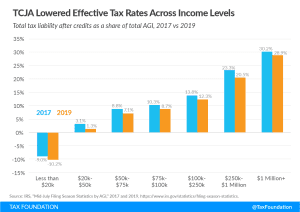

Initial 2018 IRS tax return data shows that the TCJA expanded the use of several credits and deductions, made the standard deduction more favorable than itemizing, reduced tax refunds, and lowered taxes for most Americans.

4 min read

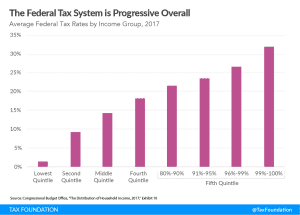

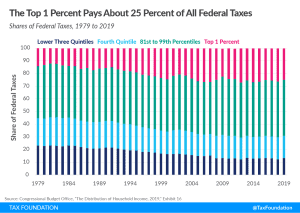

Contrary to the perceptions of some, new data indicate that (1) income earned after taxes and transfers has increased over the past several decades for all income groups; (2) the federal tax system is increasingly progressive; and (3) that system relies heavily on higher earners to raise revenue for government services and means-tested transfers.

3 min read

The latest IRS data continues to illustrate that the net effect of the Tax Cuts and Jobs Act was to reduce effective tax rates across income groups. In 2019, the TCJA again expanded the use of several deductions and credits, made the standard deduction more favorable than itemizing, and lowered taxes for most taxpayers.

4 min read

The Biden corporate tax plan would disproportionately harm these congressional districts and make the U.S. less internationally competitive. These tax hikes, along with individual tax increases, would also raise taxes on net for 96 percent of congressional districts by 2031 after these temporary credits expire in 2025.

2 min read

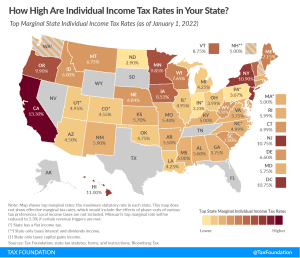

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read