All Related Articles

9232 Results

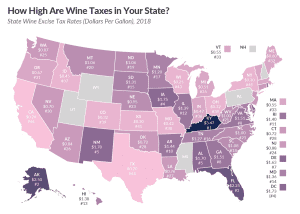

How High Are Wine Taxes in Your State?

1 min read

Tax Reform 2.0 Framework a Good Start

2 min read

Five States Accomplish Meaningful Tax Reform in the Wake of the Tax Cuts and Jobs Act

Georgia, Idaho, Iowa, Missouri, and Utah capitalized upon the Tax Cuts and Jobs Act’s (TCJA) changes by conforming to increase their annual state revenues.

5 min read

State-by-State Job Impacts of the Tax Cuts and Jobs Act in 2018

Our updated analysis of the state-by-state impact of the Tax Cuts and Jobs Act shows that the new federal tax law will create 215,000 full-time equivalent jobs in 2018. Here’s how each state will be affected.

2 min read