All Related Articles

Taxes in Everything: Die Hard Edition

It’s Christmas time, and for millions of families around the country, that means revisiting some classic holiday movies. For some, that includes It’s a Wonderful Life and Home Alone. For others, that includes Die Hard.

3 min read

State Tax Changes Taking Effect January 1, 2023

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

Improved Tax Treatment of Saving Included in Year-End Federal Spending Deal

The year-end omnibus federal spending package makes a number of reforms to retirement savings accounts.

3 min read

Digital Services Taxes: Is There an End in Sight?

As it stands, Pillar One would usher in the end of many digital services taxes (though perhaps not all) at the cost of increased complexity (in an already complex and uncertain system).

4 min read

Bonus Depreciation and New Corporate Investment in 2018

If bonus depreciation is allowed to phase out, then the tax bias against capital investments will increase, discouraging firms from making otherwise profitable investments.

14 min read

Would Americans Make Charitable Donations without Tax Incentives?

Over the long run, tax policies that grow after-tax incomes and the economy do more to boost charitable giving than policies that try to incentivize people to be charitable.

9 min read

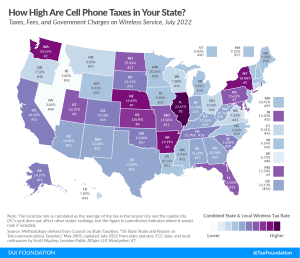

Excise Taxes and Fees on Wireless Services Increase Again in 2022

While the wireless market has become increasingly competitive in recent years, resulting in steady declines in the average price for wireless services, the price reduction for consumers has been partially offset by higher taxes.

41 min read

All I Want for Christmas is EU: Understanding Tax Policy in Brussels

When it comes to international economic competition, people often frame the argument as the U.S. versus China. But across the Atlantic, nation-states in the European Union have been working hard to show the world that they deserve to be considered an economic force. Rising up to this challenge for the EU is easier said than done.

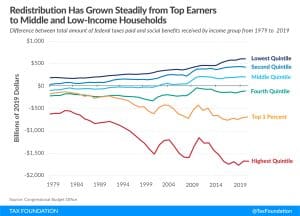

Federal Fiscal System Is Very Progressive, Latest CBO Report Shows

New CBO data shows that the current U.S. fiscal system—both taxes and direct federal benefits—is very progressive and very redistributive.

7 min read