From Temples to Tax Forms—Indiana Jones’s Guide to Taxing Treasures

As fans around the world anticipate the final adventure of Indiana Jones, let’s embark on our own excursion to unravel the mysteries of taxing treasure.

3 min read

As fans around the world anticipate the final adventure of Indiana Jones, let’s embark on our own excursion to unravel the mysteries of taxing treasure.

3 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

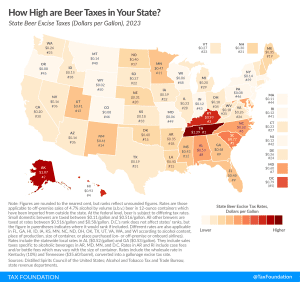

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.