New Report Identifies Challenges with Global Minimum Tax Implementation in the EU

European Union Member States are in the process of implementing the global minimum tax in line with a directive unanimously agreed to at the end of 2022.

3 min read

European Union Member States are in the process of implementing the global minimum tax in line with a directive unanimously agreed to at the end of 2022.

3 min read

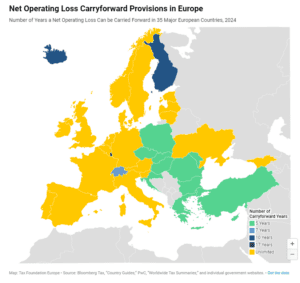

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

The Moore case could have important impacts on tax policy.

5 min read

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

7 min read

For U.S. policymakers looking to encourage greater saving and financial security, particularly among low- and moderate-income households facing serious affordability challenges, the experiences in both the UK and Canada indicate that universal savings accounts are an effective policy tool to help reach that goal.

4 min read

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read

Calling the latest round of tariffs “strategic” does not change the underlying reality: these policies are just another form of protectionism, and therefore, subject to all the same economic problems.

4 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

Gross receipts taxes impose costs on consumers, workers, and shareholders alike. Shifting from these economically damaging taxes can thus be a part of states’ plans for improving their tax codes in an increasingly competitive tax landscape.

7 min read

When Caitlin Clark and Angel Reese made their WNBA preseason debuts, basketball fans across the country tuned in. But there’s another audience that also follows along: state revenue officials, who will expect their piece of the pie each time these star athletes—and their teammates—come to town.

3 min read