All Related Articles

9232 Results

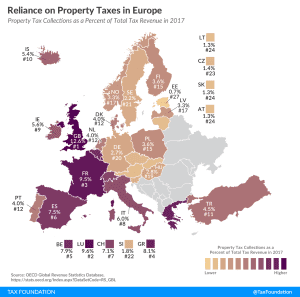

Reliance on Property Taxes in Europe

1 min read

Measuring Opportunity Zone Success

16 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

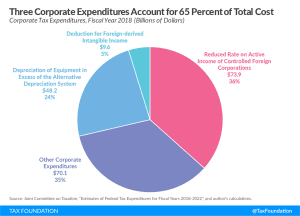

Not All Tax Expenditures Are Equal

The debate in Washington, D.C. often centers around tax expenditures, so-called corporate loopholes, in the tax code. But not all tax expenditures are created equal. Some represent neutral tax treatment and should be left alone, while others are distortionary and should be repealed. Understanding what a tax expenditure represents is essential for understanding how our tax code works for both businesses and individuals.

4 min read