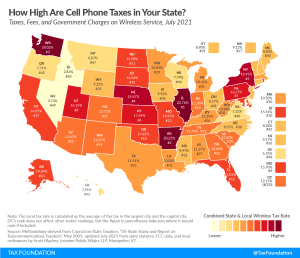

Wireless with Strings Attached

As of 2020, there were 448 million active cell phone and wireless plans in the U.S. than there were Americans. The taxes on those plans brought in approximately $11.3 billion and constituted a record 24.96 percent of the cost of an average cell phone bill. Explore why cellphone taxes are climbing, the places they’re the highest, the consumers they impact the most, and how things can be improved.