Taxing Life Insurance

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

As Congress attempts to prevent the expiration of major Tax Cuts and Jobs Act provisions, it needs to find ways to pay for them. Ideally, it should use the least economically harmful means possible.

3 min read

The proposed changes to federal tax code conformity in Oregon are a good example of a change that could significantly reshape the state’s tax code in the future, despite being framed as temporary technical adjustments.

4 min read

The Trump administration recently announced a new round of so-called “reciprocal” tariffs, ranging from 10 percent to 50 percent, assigned to nearly every US trading partner. There’s a problem with its notion of “reciprocity,” though. The White House’s tariffs are intended to be real, while the so-called tariffs it is responding to are fake.

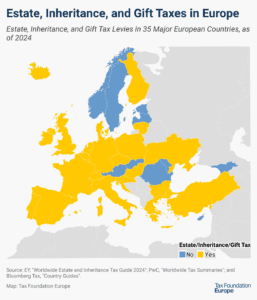

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Among the many other tax proposals being considered in Washington this year, policymakers have proposed separate bills that would impose a carbon tax on cigarettes and implement a state-wide flavor ban on tobacco products.

3 min read

Attempting to defend Trump’s tariffs, the White House points to studies that show they raise prices, cut manufacturing output, and lead to costly retaliation.

Congressional Republicans are looking for ways to pay for extending the tax cuts scheduled to expire at the end of the year. Repealing the green energy tax subsidies expanded or introduced in the Inflation Reduction Act is an appealing option.

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

Despite characterizing the tariffs as “reciprocal,” the White House didn’t actually measure tariffs, currency manipulation, or trade barrier policies employed by other countries. Instead, it drew its estimates from something else entirely: bilateral trade deficits in goods.

7 min read