All Related Articles

2021 State Business Tax Climate Index

166 min read

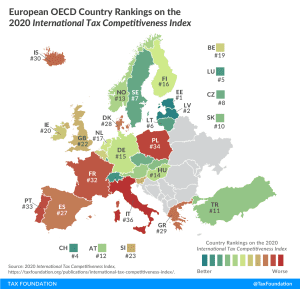

International Tax Competitiveness Index 2020

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

Tax Modernization: A Key to Economic Recovery and Growth in Nebraska

A competitive tax code has never been more important, and these tax policy improvements can both strengthen the short-term economic recovery and promote long-term economic growth in Nebraska.

26 min read

Twelve Things to Know About the “Fair Tax for Illinois”

Heading into Election Day, the Illinois legislature and Governor J.B. Pritzker (D) are trying to convince voters to scrap a key constitutional feature of Illinois’ tax system: a provision in the state constitution that prohibits a graduated-rate income tax.

18 min read

A Carbon Tax to Make the TCJA’s Individual Provisions Permanent

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

Split Roll Initiative in California Threatens Property Tax Limitations on Commercial Real Estate

On Election Day this year, California voters will vote on Proposition 15, a ballot measure that would create a “split roll” property tax system in the Golden State, increasing taxes on just commercial property by $8 billion to $12.5 billion.

15 min read

Looking Back on 30 Years of Carbon Taxes in Sweden

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

Who Will Pay for the Roads?

The highway trust fund is on track to run out of money by 2021, states are struggling to cover their transportation spending, and increased fuel economy, plus inflation, is chipping away at gas tax revenue year. How can Congress and state governments ensure they have the revenue necessary to fund our highways? One solution is the vehicle miles traveled (VMT) tax.

35 min read

Teleworking Employees Face Double Taxation Due to Aggressive “Convenience Rule” Policies in Seven States

States can tax your income where you live and where you work—but a growing number of states may also seek to tax your income even if you neither live nor work there, an aggressive posture that becomes increasingly consequential as more Americans work remotely both during and potentially after the COVID-19 pandemic.

15 min read