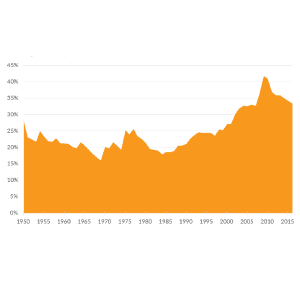

A Growing Percentage of Americans Have Zero Income Tax Liability

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read