All Related Articles

1306 Results

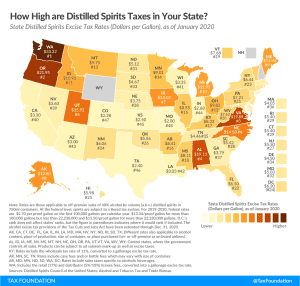

Distilled Spirits Taxes by State, 2020

2 min read

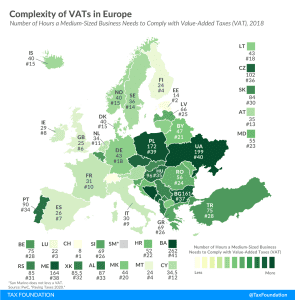

Complexity of VATs in Europe

2 min read

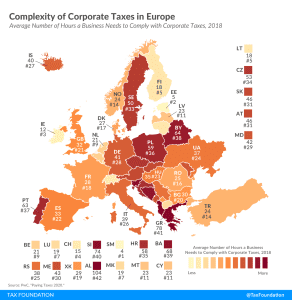

Complexity of Corporate Taxes in Europe

3 min read

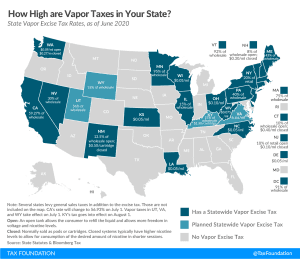

Vaping Taxes by State, 2020

Many states may be looking toward vapor and other excise taxes to fill budget holes caused by the coronavirus crisis. While those areas may represent untapped revenue sources for many states, taxing those activities is unlikely to raise much revenue in the short term.

3 min read

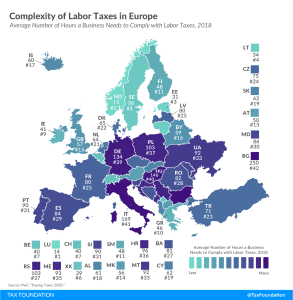

Complexity of Labor Taxes in Europe

2 min read

Tax Relief for Families in Europe

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

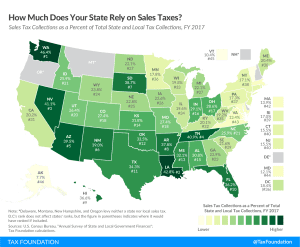

To What Extent Does Your State Rely on Sales Taxes?

Consumption taxes, like sales taxes, are more economically neutral than taxes on capital and income because they target only current consumption.

3 min read