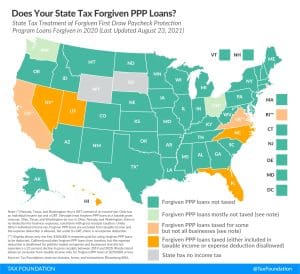

Which States Are Taxing Forgiven PPP Loans?

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

11 min read