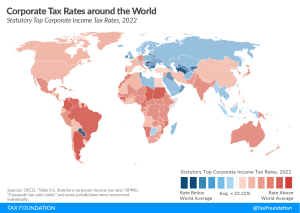

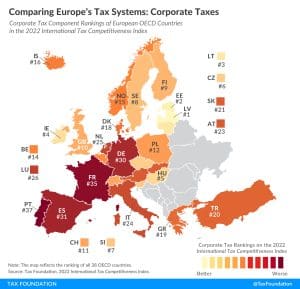

Corporate Tax Rates around the World, 2022

A new report shows that corporate tax rates around the world continue to level off. “We aren’t seeing a race to the bottom, we’re seeing a race toward the middle,” said Sean Bray, EU policy analyst at the Tax Foundation.

25 min read