The House of Representatives on Wednesday passed the SAFE Banking Act on a 321 to 103 vote. If this bill passes the Senate and becomes law, it could have great implications for several states’ cannabis excise tax revenues.

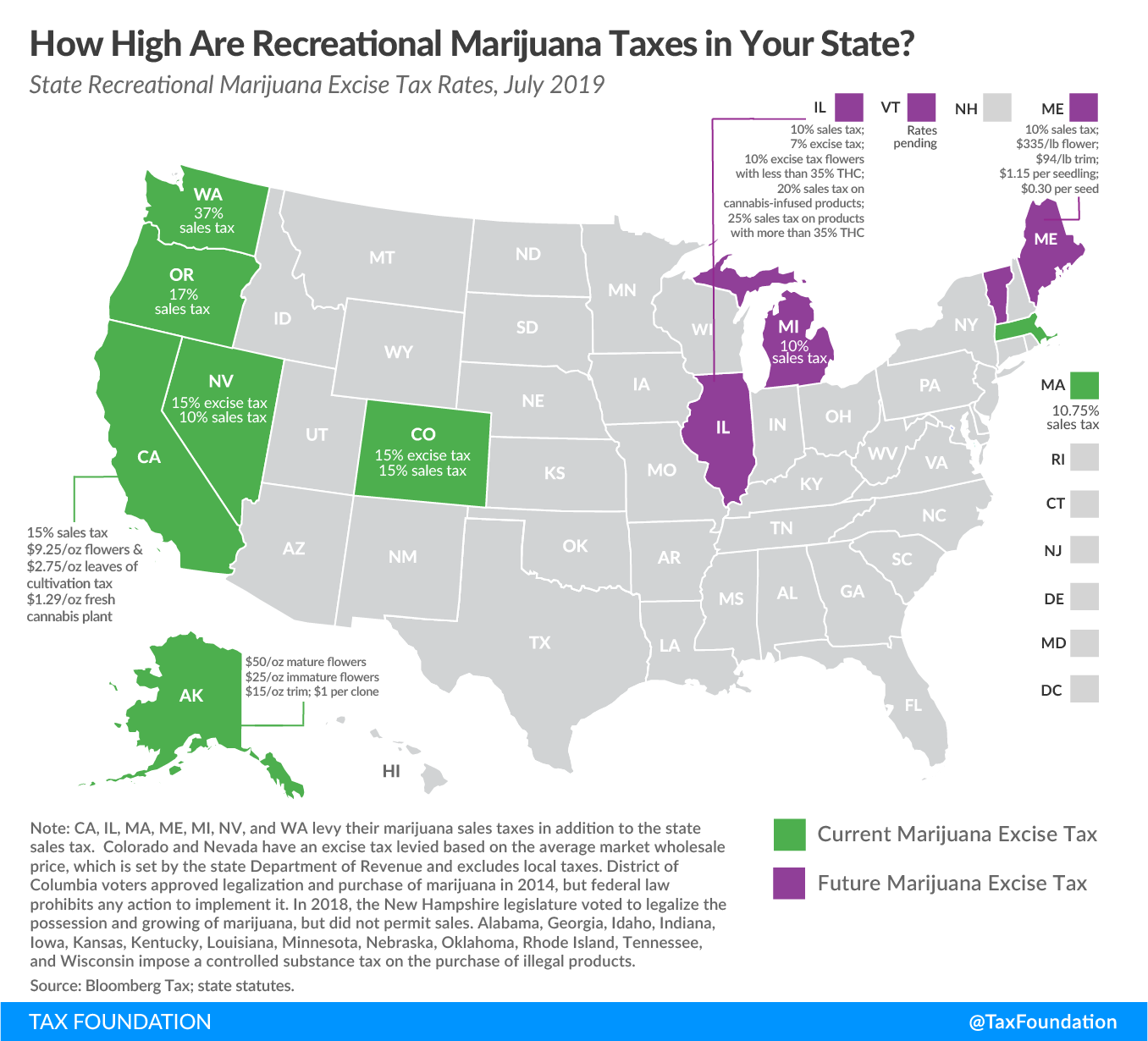

Eleven states have legalized adult-use recreational marijuana, but only seven states have operational markets with taxes levied on cannabis products. Cannabis is still a Schedule 1 controlled substance and is against federal law, which has hindered normal business operations for cannabis-related businesses. For instance, access to banking has been limited and much of the industry operates on a cash basis. That could change, if the SAFE Banking Act passes the Senate. The bill is not predicted to completely revolutionize the industry overnight but could provide some cover for credit and banking institutions to go into business with cannabis operations.

What sounds like good news to the cannabis industry could, however, spell trouble for state excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenues. Out of the seven states with operational taxable markets, six have price-based excise structures, and revenues would suffer if prices decline in a more competitive market.

Access to proper banking would likely drive down prices and allow for greater competition. For instance, start-up loans have been difficult to obtain due to the federal ban on the product. Traditional banking also limits risk of violence. Currently, dispensaries sit on large amounts of cash. Getting access to use of credit cards, checks, payroll systems, and regular banking is a big priority for the industry.

Cannabis prices have already dropped substantially since the early days of legalization. In Alaska prices went from about $4,000 a pound to about $2,300 a pound. Currently the average price per pound is around $1,400 nationally. These prices could drop further as a result of federal regulation changes.

States should be aware of this when designing and maintaining their excise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. structure for cannabis. Only Alaska’s system is safe from the effects of volatile cannabis prices, as it is purely weight-based and guarantees $800 in revenue per pound. Generally, excise taxes are imposed at a specific amount regardless of the price, but seven out of eight states have chosen the ad valorem option for marijuana. The complexity and wide variety of products make an ad valorem tax a simpler approach but these seven states risk losing out on forecasted revenue if prices continue to go down. Colorado and Nevada have hedged their structures by basing part of their price-based taxation on a government-set average cost based on weight.

Competitive prices might be good for attracting more consumers from the black market but could be problematic for states where revenues are earmarked for specific government programs—a practice that should be avoided as much as possible. So far, the substantial growth of the first years after legalization has made it difficult to conclude which tax system offers the most stability long term. Federal regulation might change that.

But first things first. It’s no certainty the bill in the Senate will get through committee let alone make it to the floor or get passed and signed into law. But these developments in Washington, D.C. serve as a reminder to state governments, which have already legalized marijuana or are considering doing so, that there are trade-offs associated with any approach to marijuana taxation, and that there is still much to learn about how best to tax these products.

Share this article