Chuck Marr over at the Center for Budget and Policy Priorities seems pretty upset over the new Rubio-Lee tax reform plan. He is calling it a “Huge new windfall at the top.” He is also concerned about the plan not addressing the soon-to-expire temporary expansion of the Child Tax Credit. “The plan creates something that’s even more tilted—outrageously so—in favor of the country’s highest-income people and likely much more fiscally irresponsible.”

He points to two pieces of the Rubio-Lee plan as being large windfalls for high income taxpayers.

First, the plan eliminates taxes on capital gains and dividends.

Second, the Rubio-Lee plan lowers the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. for pass-through business income from the current 39.6 percent to 25 percent.

He is correct that just cutting those taxes alone would create a sizeable benefit for high income earners since they earn the majority of investment and business income.

But, Rubio-Lee’s plan does not just cut those taxes. His analysis misses almost every other part of the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. plan. Specifically these three pieces:

- The elimination of most itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. , which is a large tax increase on high-income earners

- A new, expanded $2,500 child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. that cuts taxes for most taxpayers

- The elimination of the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. and personal exemption for a new refundable tax creditA refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit (EITC). . Potentially worth as much as $1,750, this is a large tax cut for the lowest income earners.

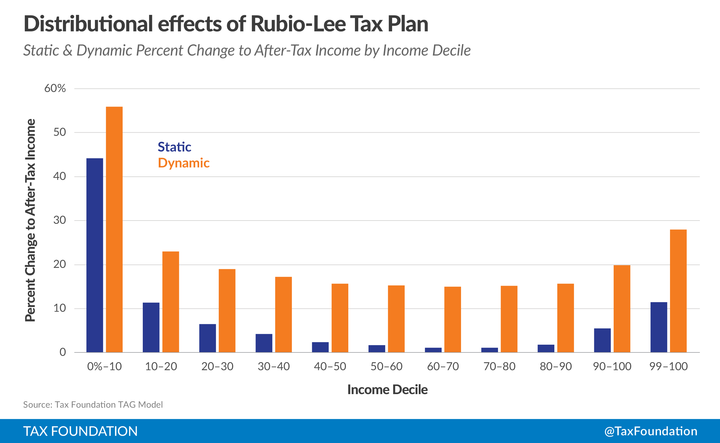

If you take all the pieces of the Rubio-Lee tax plan together, it actually produces the largest increase in after-tax income for the lowest income earners, not the highest.

According to our analysis, the bottom decile of taxpayers will see an increase in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. of 44.2 percent, a percentage increase in income nearly four times larger than the top 1 percent’s increase in after-tax income. But the plan doesn’t just increase the after-tax income of the top and the bottom. All taxpayers will see higher after-tax incomes due to this plan.

And if you account for the increased economic growth that the plan will produce, income for all taxpayers will increase even more. The bottom decile will see a 55 percent increase in after-tax income.

Distributional analysis is important. It gives us insight into who is currently paying taxes and how proposals will change that distribution. But when doing that sort of analysis, you should incorporate all relevant changes. Otherwise you may end up making the wrong conclusion.

Share this article