Key Findings

- The medical device taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , part of the Affordable Care Act, is a 2.3 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on the price of taxable medical devices sold in the United States.

- The tax has been suspended since 2016, but the current moratorium will expire by the end of 2019, unless Congress extends it or repeals the tax outright.

- If imposed, the excise tax would result in a decline of 21,390 full-time equivalent jobs and a reduction in GDP of $1.7 billion.

- Research has been published confirming the negative effects of the medical device tax on industry and consumers. The tax fails to lower health-care costs for consumers but increases costs and burdens on the health-care industry.

- The medical device tax is not sound tax policy due to its complexity and adverse economic effects.

Introduction

In 2010, Congress enacted the comprehensive health-care reform known as the Affordable Care Act (ACA). A small but important part of the bill was the medical device tax, an excise tax based on the price of medical devices. It is levied either on the manufacturer, producer, or importer of the device.

Currently suspended, the tax was in effect between 2013 and 2015. While in effect, the tax resulted in higher prices as well as less research and development (R&D).

Repealing the tax has drawn bipartisan support ever since enactment. Even President Obama entertained the idea of repealing the tax,[1] which, according to the Congressional Budget office (CBO), is projected to raise approximately $25 billion over the next 10 years.

This paper examines the impact of the medical device tax on the economy and discusses the tax design in relation to the principles for sound tax policy. Congress should repeal the medical device tax because the negative effects of the tax significantly outweigh the relatively small government revenue projections.

Facts About the Medical Device Tax

The medical device tax adds a 2.3 percent excise on the value of a taxable medical device.[3] The tax is levied based on the price of the good rather than on the quantity, though this is a more traditional way to levy excise taxes.

Taxable medical devices are listed as devices with the Food and Drug Administration (FDA) under Section 510(j) of the Federal Food, Drug, and Cosmetic Act and 21 CFR part 807. Some examples include X-ray machines, hospital beds, and MRI machines. Although the definition is fairly broad, several exemptions apply.[4] The statute specifically exempts “eyeglasses, contact lenses, [and] hearing aids,” as well as medical devices “generally purchased by the general public at retail for individual use.”[5] Moreover, the tax is only levied on devices for human consumption, meaning that medical devices used for animals are exempted.[6]

The tax was in effect for three years before being suspended from 2016 until the end of 2017. Congress extended the moratorium, after a brief lapse, for 2018 and 2019.[7] Absent an extension of the moratorium, it is scheduled to take effect again on January 1, 2020.

Opponents of the tax note that, in addition to increasing the general cost of health care, it narrowly targets profit margins of one industry, thereby limiting risk-taking and investment in the medical device sector, which stifles innovation. Additionally, research indicates that the tax was responsible for a significant loss of jobs within the medical device industry while it was in effect.[8]

Proponents of the tax argue that any negative effect of the tax would be offset by the increased demand resulting from the increased health-care coverage.[9] They argue that increased coverage under the ACA, which the medical device tax minimally helps fund, drives up sales for medical devices. The Joint Committee on Taxation (JCT) and Congressional Budget Office estimate that eliminating the tax would cost approximately $1.6 billion in 2020, growing to $2.2 billion in 2021.[10]

Impact on Jobs and Economic Growth

According to the Tax Foundation General Equilibrium Model, reinstating the medical device tax would result in a loss of 21,390 full-time equivalent jobs within the medical device industry. Our estimates also indicate that the tax would reduce gross domestic product (GDP) by $1.7 billion. Other estimates have ranged from 47[11] and 45,000 workers, with the former predicated on the assumption that the tax would be passed on to consumers.[12] Industry-supported research estimated a job loss of 29,000 while the tax was in effect between 2013 and 2015.[13]

|

Source: Tax Foundation General Equilibrium Model, November 2019 |

|

| Gross Domestic Product | -$1.739 billion |

| Full Time Job Equivalence | -21,390 |

All estimates must deal with some inherent uncertainties. The impact on the industry is dependent, first, on the medical device companies’ decision-making and second, their ability to pass on costs to the buyers of medical devices. This ability is determined by their market power.

Most hospitals operate through group purchasing organizations (GPO) to use combined purchasing power to get lower prices from device manufacturers. This bargaining power of hospitals could make it difficult for manufacturers to pass on the cost of this tax.[15] Conversely, small companies, with fewer than 50 employees, make up 80 percent of the medical device industry. The tangible job loss experienced between 2013 and 2015 illustrates the imbalance of power and that medical device companies had to cover the cost by reducing their workforce.

Research from Iowa State University confirms this in a study of the medical device tax’s impact on research and development (R&D). Daeyong Lee, Assistant Professor in Human Development & Family Studies at Iowa State University, found that industry R&D expenses decreased by an average of $34 million per company* in 2013 and sales of medical devices decreased by an average of $188 million per company*.[17] That means less innovation and as a result, worse patient care.

*Erratum: These statistics have been updated for clarity. Numbers reflect per company averages, not industry totals.

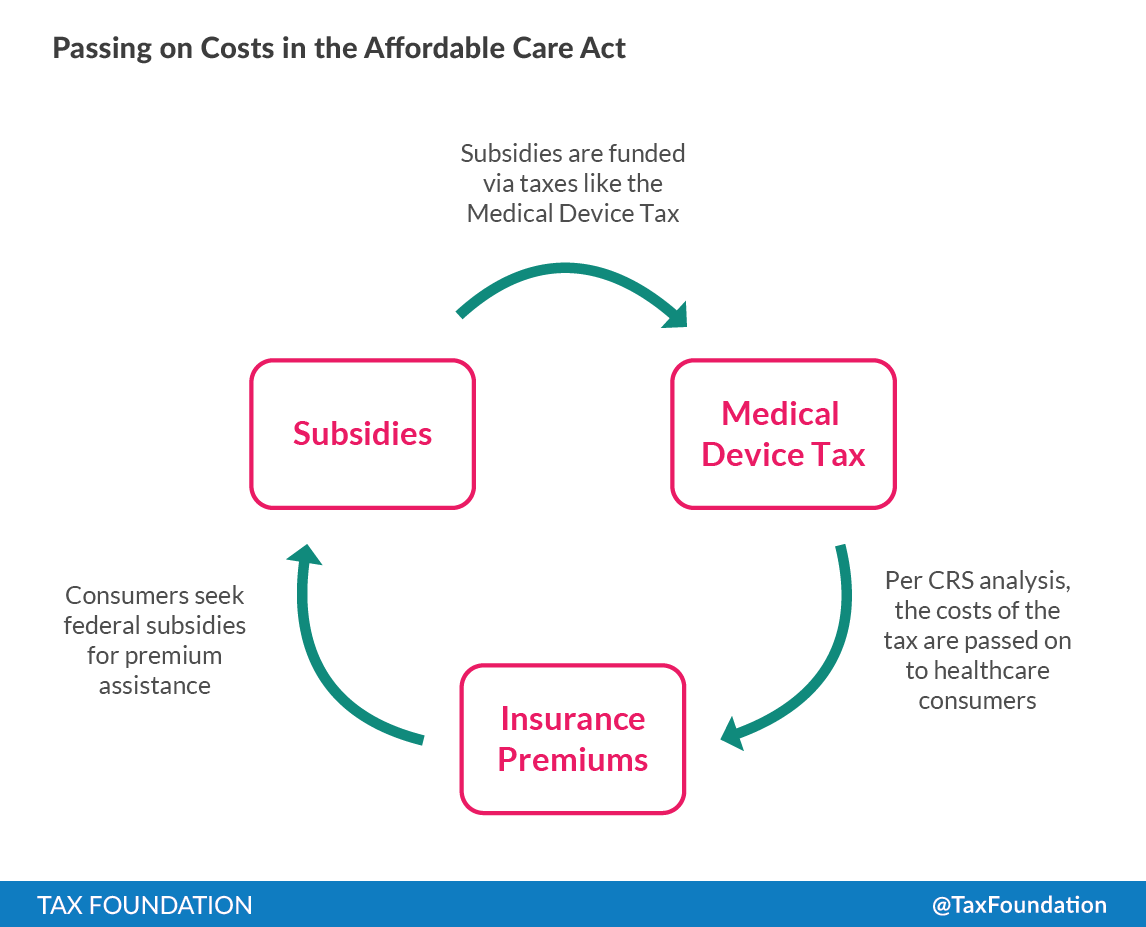

Others suggest that the cost is passed on to the consumers in the form of higher prices, limiting the effect on the medical device industry. A paper from the Congressional Research Service (CRS), for instance, suggests that demand for medical devices is relatively inelastic and any cost on the industry would be negligible.[18] But even if that is the case, the medical device tax would increase health-care costs, countering a stated purpose of the Affordable Care Act. The CRS suggests that this may be justified because those tax dollars would return to taxpayers in the form of subsidies.[19]

If the tax is passed on to the consumers, the government would then collect taxes, in effect increasing the cost of health care, in order to subsidize those same taxpayers to help them with their rising health-care costs. [20] Far from conferring a benefit, this cycle, even if accurate, would be inefficient as administrative costs and other points of friction chip away at the redirected revenue.[21] Perhaps this is why, although the CRS analysis is more favorable to the medical device tax than most, the study still concludes that “In general, it appears that some justification for the medical device excise tax could be provided based on traditional economic principles, but the justifications, in most cases, are weak.”[22]

Principles of Sound Taxation

The medical device tax violates multiple principles of sound tax policy, which should serve as touchstones when designing tax policy.[23] The tax is neither simple, transparent, nor neutral, to the detriment of taxpayers and those in need of medical devices.

Simplicity

All tax levies come with compliance costs, but the medical device tax is overly complex. For many companies, additional staff expenses in the tax department means fewer jobs in research and development (R&D).

Unfortunately, the medical device tax is inherently complex. The tax is based on price (an ad valorem tax) rather than on quantity (a specific tax).

In some cases, medical device companies are both manufacturer and distributor. In these vertically integrated companies, for which no actual wholesale price exists, an artificially estimated value of their goods must be made to be able to calculate the tax liability. In 2012, the Treasury Department acknowledged these implementation challenges, stating that the Internal Revenue Service (IRS) would “work with stakeholders on compliance-related issues, such as the determination of price.”[24]

An additional concern is the compliance cost for smaller manufacturers. The medical device industry consists of a majority of smaller companies, and complex taxes generally puts a disproportionate burden on smaller firms as they must spend relatively more in compliance versus larger corporations.[25]

Additionally, the retail exemption grants the U.S. Treasury Secretary authority to exempt items from the tax, which further increases complexity. A Treasury Inspector General for Tax Administration (TITGA) report found discrepancies in tax reporting totaling $117.8 million for the first six months of 2013. The TITGA also found that the IRS issued 219 mistaken penalties in the same period.[26]

Transparency

The medical device tax is, like all excise taxes, built into the final price and is not visible to the consumer. Moreover, many devices are not sold to consumers, but used in medical facilities, where they constitute business inputs. Taxing business inputs can result in tax pyramiding, where the same good or service is taxed multiple times over, and fundamentally lacks transparency, yet the medical device tax falls on these inputs while many consumer purchases are covered by the retail exemption.

Exemptions in the statute makes the tax even less transparent. For instance, items from a dental laboratory would normally be exempt, but materials and equipment used by these laboratories might still be liable for tax. [27] In effect, even consumers aware of the tax would have no idea what part of the final price is impacted by this tax.

Neutrality

Taxes should raise revenue with as little economic distortion as possible. This means that taxes should be neutral, not favoring specific industries, business structures, or products. The medical device tax does live up to this principle.

Since the levy is a tax on sales, with no regard for profitability, companies with smaller profit margins would face greater tax burdens than companies with larger profit margins. In fact, manufacturers could end up paying over 100 percent of their profits in taxes, and even businesses posting losses would face the tax.

Smaller companies, particularly new start-ups, will suffer disproportionately as their margins are usually smaller. According to a study of the industry from 2013, many small device manufacturers and start-ups average net annual losses. (Excluding the top 30 manufacturers, the industry averaged a net income of -186 percent, suggesting that it is a highly competitive industry with a high failure rate.)[28]

This is one of the reasons lawmakers from both sides of the aisle have called for a repeal of the tax. They argue that the opportunity cost of enforcing the tax is too high as a great deal of innovation happens in smaller companies with slim profit margins or even significant losses unless and until their device gains wide acceptance.[29]

The retail exemption also discriminates between health-care products based on the intended consumer. In the inverse of sound tax policy, final consumer transactions are outside the base, while business-to-business purchases are taxed. Low rates and broad bases are almost axiomatic in tax policy; the medical device tax falls far short of this standard as well.

Conclusion

The medical device tax is flawed tax policy. The negative effects of the tax outweigh the relatively small projected revenue. The Tax Foundation’s model estimates a decline of 21,390 full-time equivalent jobs in the medical device industry and a negative impact on GDP of $1.7 billion.

To the extent the tax is covered by manufacturers, it will negatively affect employment and innovation in the medical device industry, especially among small companies. To the extent the tax is passed on to the consumer, it will result in higher health-care costs, which undermines the objective of the Affordable Care Act (ACA). In both scenarios, patients would be negatively impacted because the tax limits access to the newest medical technology through increased cost on both consumers and industry.

The tax is disproportionately complex and targets a single industry. Given that it also lacks transparency and neutrality, it is not sound tax policy and should be repealed.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Gregory W. Daniel, “5 Questions About the Medical Device Tax, and Its Potential for Repeal,” The Brookings Institution, Nov. 12, 2014, https://www.brookings.edu/opinions/5-questions-about-the-medical-device-tax-and-its-potential-for-repeal/.

[2] Congressional Budget Office, “Revenue Projections By Category,” August 2019, https://www.cbo.gov/about/products/budget-economic-data#7.

[3] 26 U.S. §4191.

[4] Internal Revenue Service, “Medical Device Excise Tax: Frequently Asked Questions,” June 28, 2019, https://www.irs.gov/newsroom/medical-device-excise-tax-frequently-asked-questions.

[5] 26 U.S. §4191(b)(2).

[6] Ibid.

[7] Pub. L. 114-113 and Pub.L.115-120.

[8] Robert Book, “Employment Effects Of The Medical Device Tax,” American Action Forum, Mar. 2, 2017, https://www.americanactionforum.org/research/employment-effects-medical-device-tax/.

[9] See Paul N. Van De Water, “Excise Tax on Medical Devices Should Not Be Repealed,” Center on Budget and Policy Priorities, Feb. 23, 2015, https://www.cbpp.org/research/health/excise-tax-on-medical-devices-should-not-be-repealed; and Jane G. Gravelle and Sean Lowry, “The Medical Device Excise Tax: Economic Analysis,” Congressional Research Service, Apr. 17, 2015, http://fas.org/sgp/crs/misc/R43342.pdf.

[10] Joint Committee on Taxation, “Estimated Budget Effects Of The Revenue Provisions Contained In The House Amendment To The Senate Amendment To H.R. 88, (Rules Committee Print 115-87) Scheduled For Consideration By The House Committee On Rules On December 19, 2018,” JCX-83-18, Dec. 19, 2018, https://www.jct.gov/publications.html?func=download&id=5151&chk=5151&no_html=1; Congressional Budget Office, “Revenue Projections By Category.”

[11] Gravelle and Lowry, “The Medical Device Excise Tax: Economic Analysis,” 18.

[12] Diana Furchtgott-Roth and Harold Furchtgott-Roth, “Employment Effects of the New Excise Tax on the Medical Device Industry,” September 2011, http://www.chi.org/uploadedFiles/Industry_at_a_glance/090711EmploymentEffectofTaxonMedicalDeviceIndustryFINAL.pdf.

[13] United States Congress Joint Economic Committee, “Medical Device Tax by the Numbers,” July 24, 2018, https://www.jec.senate.gov/public/index.cfm/republicans/2018/7/medical-device-tax-by-the-numbers.

[14] Medicare Payment Advisory Commission, “Report to the Congress: Medicare and the Health Care Delivery System,” June 2017, 220, http://www.medpac.gov/docs/default-source/reports/jun17_reporttocongress_sec.pdf?sfvrsn=0.

[15] Kyle Pomerleau, “The ACA Medical Device Tax: Bad Policy in Need of Repeal,” Tax Foundation, Apr. 9, 2013, https://taxfoundation.org/aca-medical-device-tax-bad-policy-need-repeal.

[16] Matt Dolan, “Innovation 101 – Technology & Innovation in the Medical Device Industry,” Roth Capital Partners, Sept. 13, 2012, http://www.roth.com/files/marketing/email_blasts/Roth%20Capital%20CONNECT.pdf.

[17] Daeyong Lee, “Impact of the Excise Tax on Firm R&D and Performance in the Medical Device Industry: Evidence from the Affordable Care Act,” Research Policy 47:5 (June 2018), 854-871, https://www.sciencedirect.com/science/article/pii/S0048733318300416?via%3Dihub.

[18] Gravelle and Lowry, “The Medical Device Excise Tax: Economic Analysis,” 7.

[19] Ibid., 5.

[20] See Alan Cole, “CRS Report: Medical Device Tax Burden Falls On Consumers,” Tax Foundation, Mar. 6, 2015, https://taxfoundation.org/crs-report-medical-device-tax-burden-falls-consumers/.

[21] Ibid.

[22] See Gravelle and Lowry, supra note 16.

[23] Tax Foundation, “Principles of Sound Tax Policy,” https://taxfoundation.org/principles/.

[24] Federal Register, 77:236, Dec. 7, 2012.

[25] J. Scott Moody, “The Impact of Tax Complexity on Small Businesses,” Tax Foundation, Sept 1., 2000, http://taxfoundation.org/article/impact-tax-complexity-small-business.

[26] Treasury Inspector General for Tax Administration, “The Affordable Care Act: An Improved Strategy Is Needed to Ensure Accurate Reporting and Payment of the Medical Device Excise Tax,” 2014-46-043, July 17, 2014, https://www.treasury.gov/tigta/auditreports/2014reports/201443043fr.pdf.

[27] Journal of Dental Technology, “The Medical Device Excise Tax & Dental Laboratory Made Devices,” November/December 2012, http://www.trojanonline.com/MDT-Taxable%20Medical%20Device%20NADL%20Analysis%20Sheet_.pdf.

[28] Consumers Union, “Medical Device Manufacturer Profits,” Health Policy Brief, September 2013, https://advocacy.consumerreports.org/wp-content/uploads/2013/10/Medical_Device_Report.pdf.

[29] See Elizabeth Warren, “Mass. Sen. hopeful Elizabeth Warren on the device tax, the FDA and a climate for innovation,” MassDevice.com, Apr. 17, 2012, https://www.massdevice.com/mass-sen-hopeful-elizabeth-warren-device-tax-fda-and-climate-innovation/.

Share this article