Monday, the Office of Management and Budget (OMB) released the White House’s fiscal year 2021 budget proposal, kicking off the first step of the budget process for the next fiscal year. The president’s budget, while only a set of recommendations sent to Congress, communicates the White House’s policy priorities and is an opportunity to highlight areas for Congress to focus on in the budget resolution and appropriations stages of the budget process.

While the FY 2021 budget contains many changes to items such as discretionary funding levels, and changes to Medicare funding, the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. proposals within the budget are limited. For example, the budget assumes that the individual provisions of the Tax Cuts and Jobs Act (TCJA) are extended until 2035, building that extension into the budget baseline. The White House also proposes the repeal of five energy tax credits, offers tax credits for a federal Education Freedom Scholarship program, and increases the Internal Revenue Service (IRS) budget by about $15 billion over 10 years.

However, what is missing is any discussion of business tax provisions enacted in the TCJA that are set to expire in the coming years. While they are not an immediate concern for policymakers in the next fiscal year, many of these provisions are pro-growth and their expiration will set the American economy back if no alternative proposals take effect.

For example, the TCJA enacted full expensing of business investment for short-life assets, which is scheduled to phase down starting on December 31, 2022. This allows firms to fully deduct the cost of these assets when incurred, rather than depreciating over several years.

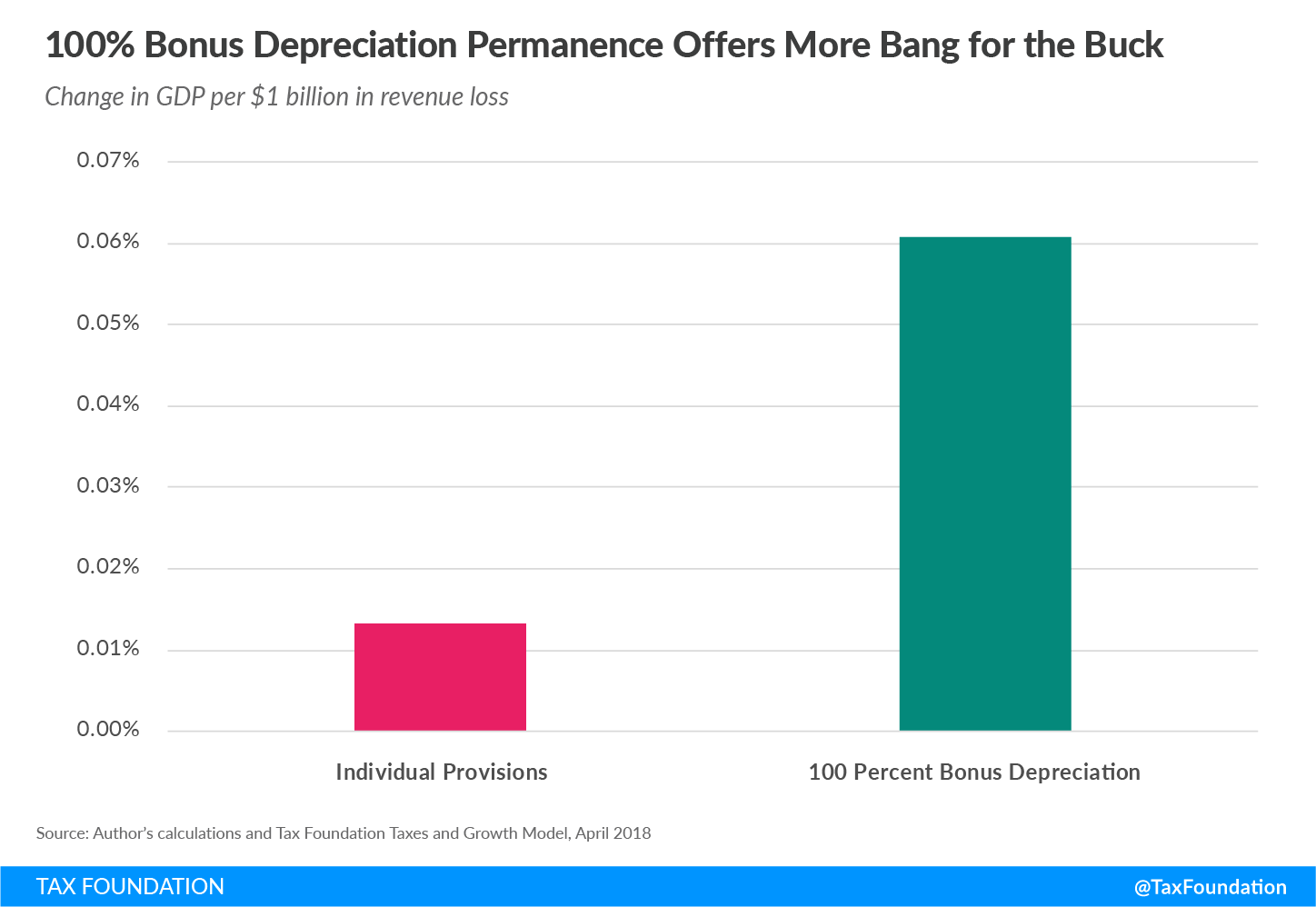

In 2027, full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. drops to 0 percent, reverting to the standard depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules set under the Modified Accelerated Cost RecoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. System (MACRS). This treatment would be worse than under prior law in 2017, which permitted 50 percent bonus depreciation for short-life assets. Full expensing was one of the most significant provisions of the TCJA, and if made permanent would be one of the most cost-effective ways to increase growth. This should be of interest to policymakers who are interested in the budget impact of tax changes while preserving economic growth.

In addition to a phaseout in 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , in 2022, research & development (R&D) expenses will need to be amortized over five years instead of being expensed under current policy. This change raises the cost of investment and discourages R&D spending, reducing economic output by up to 0.15 percent in the long run. That estimate excludes the effect of lower innovation in the American economy, which could reduce output further.

Using the Tax Foundation’s General Equilibrium Model, we estimate that economic output would be 1.17 percent larger in the long run if 100 percent bonus depreciation were made permanent and the planned amortization of R&D expenses were canceled. This change would also raise wages by nearly 1 percent, raise the capital stock by 2.22 percent, and generate about 250,000 full-time equivalent jobs.

|

Source: Tax Foundation General Equilibrium Model, November 2019. |

|

| Gross Domestic Product (GDP) | +1.17% |

| Wage Rate | +0.99% |

| Capital Stock | +2.22% |

| Full-Time Equivalent Jobs | +256,615 |

In the next few years, businesses will also need to contend with a tightening of the interest deduction limitation and a higher minimum tax rate on global intangible low tax income (GILTI). While there are trade-offs involved with each of these changes, they will be a headwind for businesses as they phase in over the decade.

Congress must address the phasing out of both business and individual provisions of the TCJA over the coming years. While the individual tax provisions—including the Section 199A pass-through deduction—deserve attention and an opportunity for improvements, policymakers should also focus on extending the pro-growth business provisions of the TCJA and find opportunities for bipartisan cooperation in order to secure a alternative path to their expiration.

Share this article