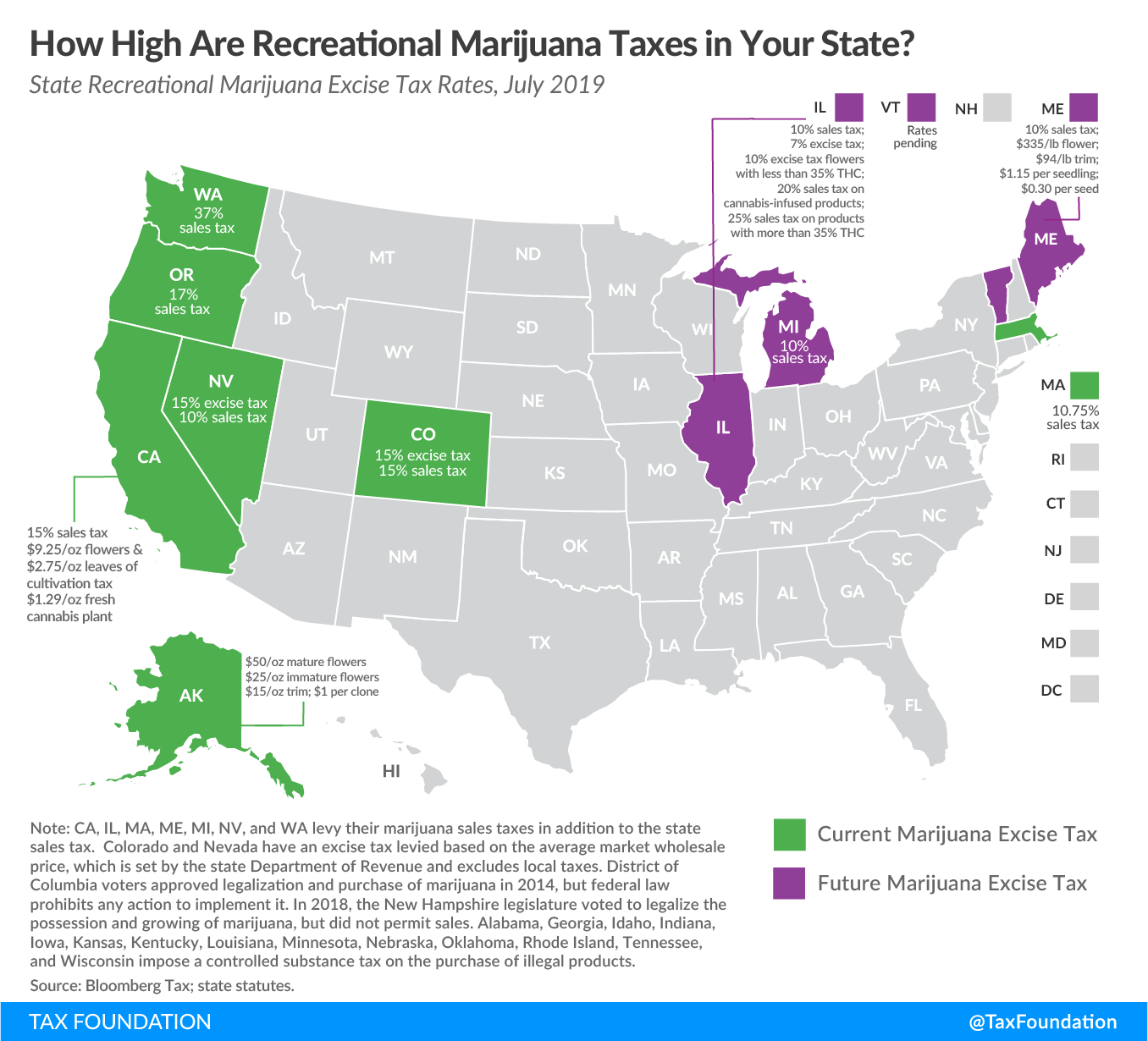

Ahead of the upcoming legislative sessions, Pennsylvania and New Mexico are considering legislative action which would legalize the sale of adult recreational marijuana, joining 11 other states and the District of Columbia.

Both Pennsylvania and New Mexico are considering excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. models applied to the retail selling price. In Pennsylvania, Senators Daylin Leach (D) and Sharif Street (D) have introduced a bill that would taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. marijuana 17.5 percent in addition to the state’s 6 percent sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . The revenue raised through this measure would be deposited into the Adult-Use Cannabis Fund, with the sponsors projecting $500 million in the first full year of operation.

In New Mexico, a governor-appointed working group published recommendations for marijuana regulation and suggested a state excise tax rate of 5 percent and another 5 percent in local excise taxes. Combined with gross receipts taxes, the average tax level would be 17 percent. The working group emphasizes a need to remove incentives from illicit market sellers and estimates revenue of $54.5 million in the first year. These funds would be allocated to law enforcement, the Department of Health, and the Cannabis Venture Fund.

Compared to neighboring states, Pennsylvania’s proposal would result in a 23.5 percent rate at point of sale, which is close to Massachusetts’ combined rate of up to 20 percent. Michigan levies a combined rate of 16 percent. Illinois has developed a more complicated system, with a 7 percent tax on sales between cultivators and producers as well as a combined rate at the retail level between 19.5 percent and 37.75 percent depending on the potency of the product.

New Mexico’s proposed combined tax rate is much lower than California’s, which levies a weight-based tax on growers on top of a 15 percent excise tax and 7.5 percent sales tax. Many localities in California levy an additional tax of up to 9.75 percent. Nevada taxes the product at the wholesale level with a 15 percent excise taxed based on a government-established average price (called Fair Market Value) as well as a 10 percent tax at the retail level in addition to the state sales tax of 4.6 percent. Colorado is similar to Nevada, applying a 15 percent excise tax at the wholesale level based on a state-calculated average price, in addition to a 15 percent tax at retail level.

Estimated Retail Selling Price Effects

Below are calculations based on the rates of the abovementioned states. They assume that all tax increases are passed on and that 1 ounce of marijuana cost $250. Prices do not reflect actual market conditions. Local taxes are excluded.

|

*THC is the main psychoactive compound in marijuana. Source: State statutes. |

||||

| State | Tax | Consumer Price | State Effective Rate | Allows for additional local taxes |

|---|---|---|---|---|

| Illinois | 7% wholesale tax + 10% excise tax on any products with less than 35% THC* + 6.25% state sales tax | $311 | 24% | Up to 3.5% |

| Massachusetts | 10.75% marijuana sales tax + 6.25% state sales tax | $292.5 | 17% | Up to 3% |

| Michigan | 10% marijuana sales tax + 6% sales tax | $290 | 16% | No |

| Pennsylvania | 17.5% marijuana sales tax + 6 % sales tax | $308.75 | 23.5% | Yes |

|

Note: NM’s gross receipts taxes (GRT) are included as they fall somewhere between a true GRT and a sales tax. Source: State statutes. |

||||

| State | Tax | Consumer Price | State Effective Rate | Allows for additional local taxes |

|---|---|---|---|---|

| California | $9.25/oz + 15% excise on average retail price + 7.25% sales tax | $320 | 27.9% | Yes |

| Colorado | 15% on average market wholesale price + 15% on retail price | $331 | 32.3% | Yes |

| Nevada | 15% wholesale excise tax + 10% retail excise tax + 6.85% state sales tax | $336 | 34.3% | Yes |

| New Mexico | 10% marijuana sales tax + 7% GR taxes | $292.5 | 17% | Included in GRT |

States Experience Difficulty Forecasting Revenue

Sens. Leach and Street might be too optimistic in their estimate of $500 million in revenue for Pennsylvania in the first year. No state has reached those levels yet, not even states with a more mature market like Washington or Colorado. The world’s largest marijuana market, California, raised $345 million the first year of regulated sales. Considerable obstacles should be expected in the first year of business: challenges with licenses, growing, and zoning, to name a few.

Forecasts have generally overshot, with a few exceptions. Though forecasting is getting easier as more data becomes available, it is unclear how Sens. Leach and Street arrived at $500 million. One guess would be a report published by Pennsylvania’s Auditor General which estimated tax revenue of $581 million per year. However, this figure assumes participation rate in the legal market similar to established states like Washington and Colorado as well as a higher tax above 30 percent. Finally, the report emphasizes that it will take time to “build up to the full potential of the regulated market.”

New Mexico is also in danger of overestimating its ability to establish a legal market. Oregon, which has a similar tax rate but twice the population size, raised $70 million in its first full fiscal year.

Taxing Marijuana

Both New Mexico and Pennsylvania have taken into consideration the dangers of overtaxing a new market, which is a positive development. States are still evaluating the trade-offs associated with different approaches to marijuana taxation and should be prepared to adjust their practices as lessons are learned from the experience of a growing number of states. State revenues tend to grow fast in the beginning and slow after a few years, but tax designs for marijuana have not seen their final form yet. They will continue to develop along with the marijuana market.

Earmarking revenue should be avoided as excise revenues are generally unpredictable–for marijuana in particular. It might be good politics, but it isn’t good policy. Federal policy changes or consumer behavioral changes could affect revenue as both proposals would establish tax systems which raise revenue based on retail price. Further, as markets mature or regulation is lifted, prices are likely to decline. Lawmakers should keep this in mind when appropriating projected funds from marijuana taxation.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe