One notable characteristic of this year’s presidential primaries is that many candidates have put together detailed tax plans—some of which are substantial departures from the status quo. However, no candidates would change taxes nearly as much as the two winners of last night’s New Hampshire primaries: businessman Donald Trump and Senator Bernie Sanders.

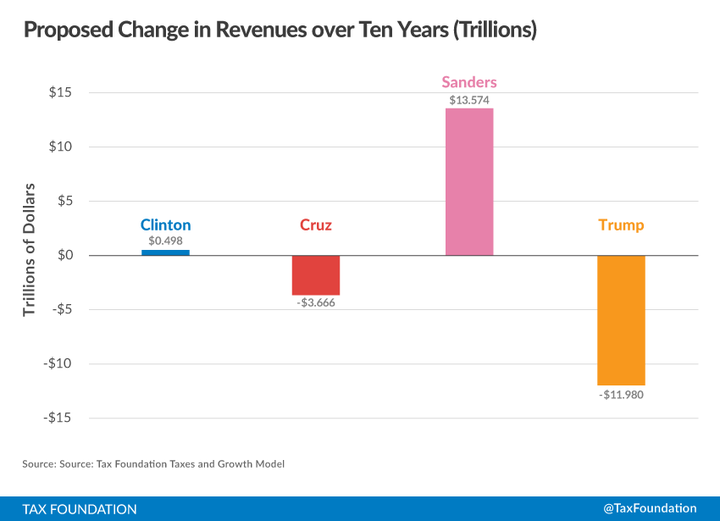

Donald Trump’s plan cuts the top income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate to 25 percent (from a high of 39.6 percent) and extends a zero income tax bracket all the way up to $50,000 for married couples. These policy choices substantially reduce revenues (despite the campaign’s sometime protestations to the contrary.) Our analysis finds the plan would reduce projected revenues by $11.98 trillion over the first decade of enactment.

In contrast, Bernie Sanders’ plan is almost exactly the opposite. It introduces several new top tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , many of them with marginal rates over 50 percent. Furthermore, it even increases taxes on low-income Americans, through its substantial use of new payroll taxes. On the whole, our analysis finds it would increase projected revenues by $13.57 trillion.

These plans would both be radical changes to the status quo; in fact, they change federal revenues by more than any other candidate plan. For some context, here’s how their plans look, in terms of revenue raised, compared to the plans of the Iowa caucus winners, Hillary Clinton and Ted Cruz:

New Hampshire and Iowa have now voted, but the remaining states are yet to vote in this primary season. Voters in those states should carefully consider their beliefs about the appropriate size of federal revenues, an issue on which the leading candidates so far differ dramatically.

Share this article